Question: Super confuse how to get the final correct answer? Please fix it step by step to get the correct answer. #26 Suppose the risk-free rate

Super confuse how to get the final correct answer? Please fix it step by step to get the correct answer.

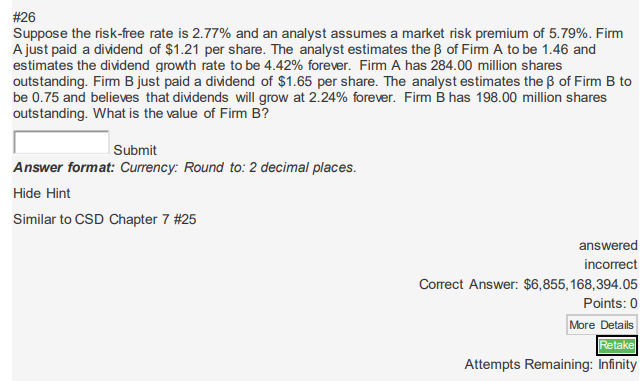

\#26 Suppose the risk-free rate is 2.77% and an analyst assumes a market risk premium of 5.79%. Firm A just paid a dividend of $1.21 per share. The analyst estimates the of Firm A to be 1.46 and estimates the dividend growth rate to be 4.42% forever. Firm A has 284.00 million shares outstanding. Firm B just paid a dividend of $1.65 per share. The analyst estimates the of Firm B to be 0.75 and believes that dividends will grow at 2.24% forever. Firm B has 198.00 million shares outstanding. What is the value of Firm B? Submit Answer format: Currency: Round to: 2 decimal places. Hide Hint Similar to CSD Chapter 7 \#25 answered incorrect Correct Answer: $6,855,168,394.05 Points: 0 Attempts Remaining: Infinity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts