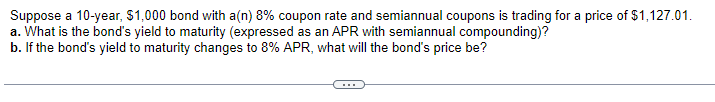

Question: Suppose a 10 -year, ( $ 1,000 ) bond with a(n) 8 coupon rate and semiannual coupons is trading for a price of ( $

Suppose a 10 -year, \\( \\$ 1,000 \\) bond with a(n) \8 coupon rate and semiannual coupons is trading for a price of \\( \\$ 1,127.01 \\). a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to \8 APR, what will the bond's price be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts