Question: Suppose a certain property is expected to produce net operating cash flows annually as follows, at the end of each of the next 5

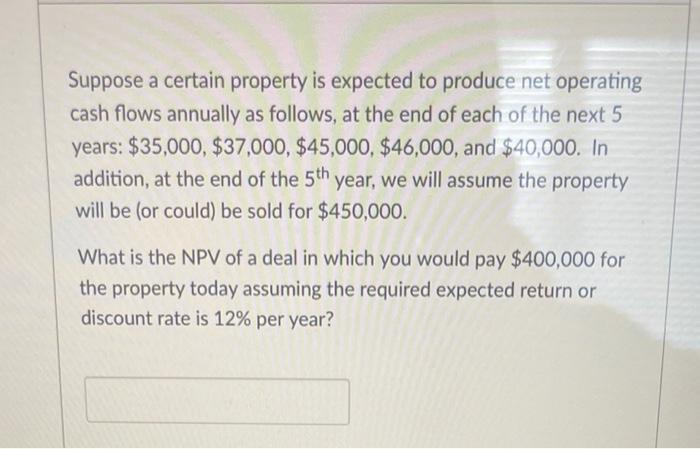

Suppose a certain property is expected to produce net operating cash flows annually as follows, at the end of each of the next 5 years: $35,000, $37,000, $45,000, $46,000, and $40,000. In addition, at the end of the 5th year, we will assume the property will be (or could) be sold for $450,000. What is the NPV of a deal in which you would pay $400,000 for the property today assuming the required expected return or discount rate is 12% per year?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV of the deal we need to discount the f... View full answer

Get step-by-step solutions from verified subject matter experts