Question: Suppose that an analyst believes that Google (GOOG) will begin paying dividends in 6.00 years. At that time, the analyst expects Google to have a

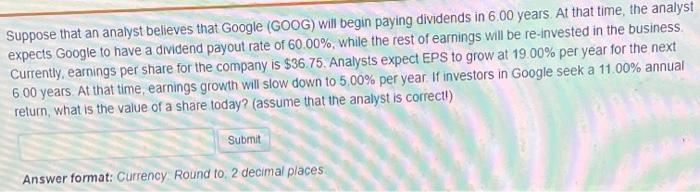

Suppose that an analyst believes that Google (GOOG) will begin paying dividends in 6.00 years. At that time, the analyst expects Google to have a dividend payout rate of 60.00%, while the rest of earnings will be re-invested in the business. Currently, earnings per share for the company is $36.75. Analysts expect EPS to grow at 19.00% per year for the next 6 00 years. At that time, earnings growth will slow down to 5.00% per year if investors in Google seek a 11.00% annual return, what is the value of a share today? (assume that the analyst is correctl) Submit Answer format: Currency Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock