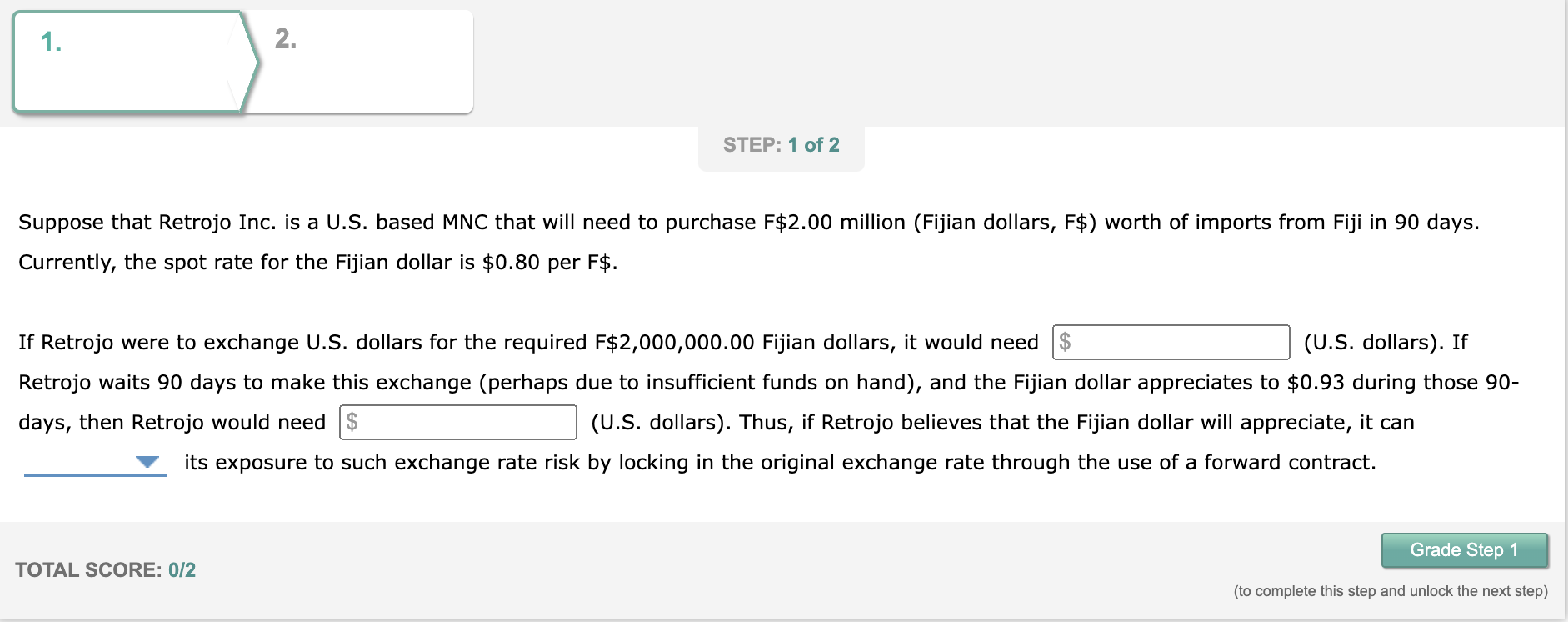

Question: Suppose that Retrojo Inc. is a U . S . based MNC that will need to purchase F$ 2 . 0 0 million ( Fijian

Suppose that Retrojo Inc. is a US based MNC that will need to purchase F$ million Fijian dollars, F$ worth of imports from Fiji in days.

Currently, the spot rate for the Fijian dollar is $ per F $

If Retrojo were to exchange US dollars for the required $ Fijian dollars, it would need

Retrojo waits days to make this exchange perhaps due to insufficient funds on hand and the Fijian dollar appreciates to $ during those

days, then Retrojo would need

US dollars Thus, if Retrojo believes that the Fijian dollar will appreciate, it can

its exposure to such exchange rate risk by locking in the original exchange rate through the use of a forward contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock