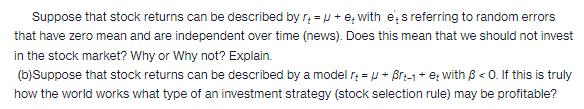

Question: Suppose that stock returns can be described by +=+e+with es referring to random errors that have zero mean and are independent over time (news).

Suppose that stock returns can be described by +=+e+with es referring to random errors that have zero mean and are independent over time (news). Does this mean that we should not invest in the stock market? Why or Why not? Explain. (b) Suppose that stock returns can be described by a model r=+Br-1 + et with 6

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

a In the given model stock returns are described by the equation r where represents random errors with a zero mean and are independent over time This implies that random fluctuations or unpredictable ... View full answer

Get step-by-step solutions from verified subject matter experts