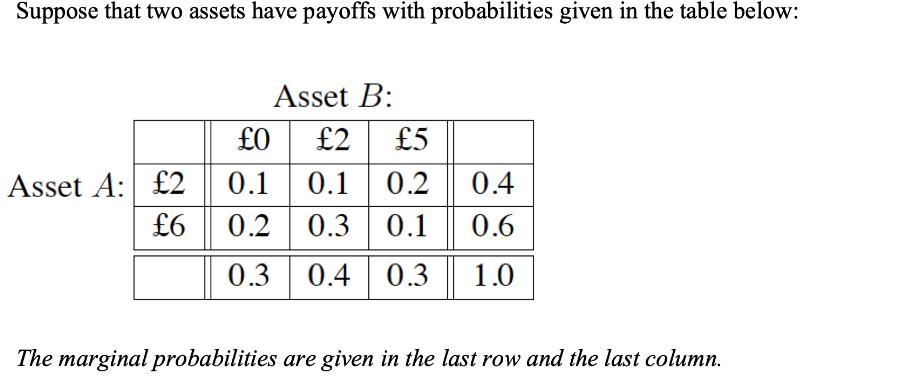

Question: Suppose that two assets have payoffs with probabilities given in the table below: Asset A: 2 6 Asset B: 0 2 5 0.1 0.1

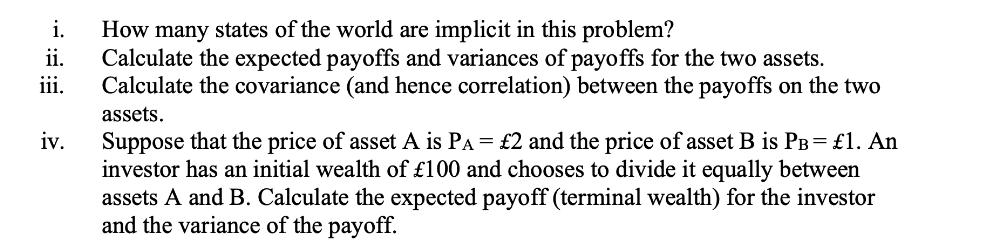

Suppose that two assets have payoffs with probabilities given in the table below: Asset A: 2 6 Asset B: 0 2 5 0.1 0.1 0.2 0.4 0.2 0.3 0.1 0.6 0.3 0.4 0.3 1.0 The marginal probabilities are given in the last row and the last column. i. ii. iii. iv. How many states of the world are implicit in this problem? Calculate the expected payoffs and variances of payoffs for the two assets. Calculate the covariance (and hence correlation) between the payoffs on the two assets. Suppose that the price of asset A is PA = 2 and the price of asset B is PB = 1. An investor has an initial wealth of 100 and chooses to divide it equally between assets A and B. Calculate the expected payoff (terminal wealth) for the investor and the variance of the payoff.

Step by Step Solution

There are 3 Steps involved in it

Answer i There are 9 states of the world in this problem since there are 9 different combinations of ... View full answer

Get step-by-step solutions from verified subject matter experts