Question: Suppose that you are working on asset allocation between the Vanguard Long-term corporate bond ETF (VCLT) and Schwab S&P 500 Index fund (SWPPX). Using the

Suppose that you are working on asset allocation between the Vanguard Long-term corporate bond ETF (VCLT) and Schwab S&P 500 Index fund (SWPPX). Using the past 5-year daily return from 2016 to 2021, I have calculated and risk and return information for VCLT and for SWPPX as following:

VCLT: expected return of 8.26% and the standard deviation is 12.87%

SWPPX: expected return of 18.62% and the standard deviation 19.01%

The correlation between VCLT and SWPPX is 0.2314

Answer the following:

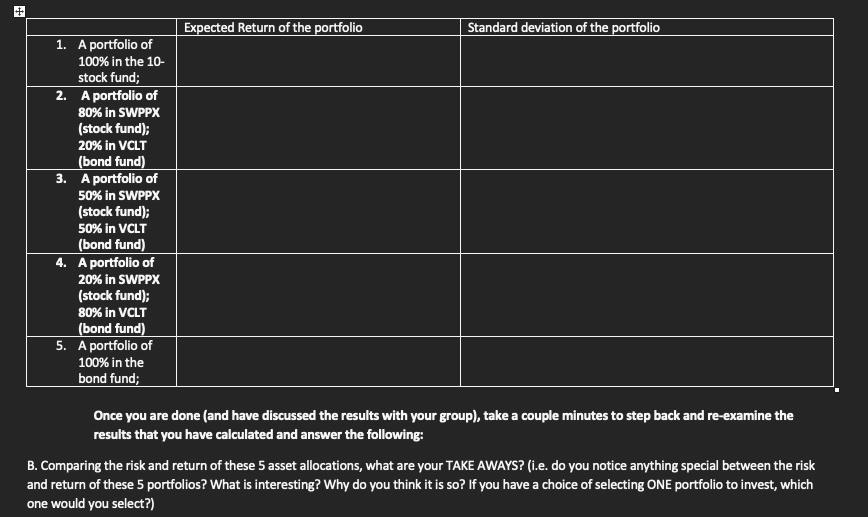

- Calculate return AND risk for a portfolio consisting of VCLT and SWPPX given various asset allocation:

+ Expected Return of the portfolio Standard deviation of the portfolio 1. A portfolio of 100% in the 10- stock fund; 2. A portfolio of 80% in SWPPX (stock fund); 20% in VCLT (bond fund) 3. A portfolio of 50% in SWPPX (stock fund); 50% in VOLT (bond fund) 4. A portfolio of 20% in SWPPX (stock fund); 80% in VCLT (bond fund) 5. A portfolio of 100% in the bond fund; Once you are done (and have discussed the results with your group), take a couple minutes to step back and re-examine the results that you have calculated and answer the following: B. Comparing the risk and return of these 5 asset allocations, what are your TAKE AWAYS? (.e. do you notice anything special between the risk and return of these 5 portfolios? What is interesting? Why do you think it is so? If you have a choice of selecting ONE portfolio to invest, which one would you select?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts