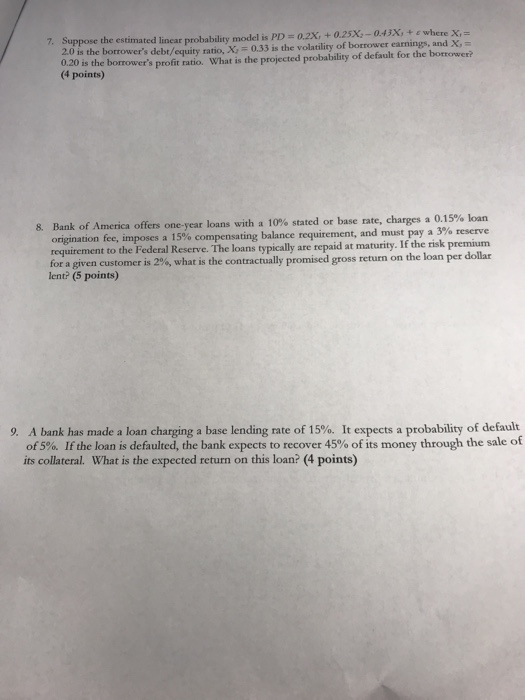

Question: Suppose the estimated linear probability model is PD = 0.2X, + 0.25x,-0.43X, + where X- 2.0 isthe borrower's debt/equity rano, X (4 points) 7. -

Suppose the estimated linear probability model is PD = 0.2X, + 0.25x,-0.43X, + where X- 2.0 isthe borrower's debt/equity rano, X (4 points) 7. - 33 is the volatility of borrower earnings, and the borrower's profit ratio. What is the projected probability of default for the botrower? one-year loans with a 10% stated or base rate, charges a 0.15% loan 3% reserve 8. Bank of America offers origination fee, imposes a 15% compensating balance requirement, and must pay a requirement to the Federal Reserve. The loans typically are repaid at maturity. If the risk premium for a given customer is 2%, what is the contractually promised gross return on the loan per dollar lent? (5 points) A bank has made a loan charging a base lending rate of 15%. It expects a probability of default of5%. If the loan is defaulted, the bank expects to recover 45% of its money through the sale of its collateral. What is the expected return on this loan? (4 points) 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts