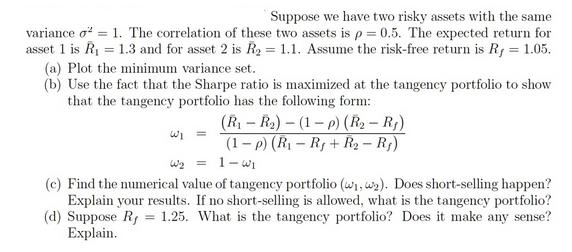

Question: = Suppose we have two risky assets with the same variance 1. The correlation of these two assets is p=0.5. The expected return for

= Suppose we have two risky assets with the same variance 1. The correlation of these two assets is p=0.5. The expected return for asset 1 is R = 1.3 and for asset 2 is R = 1.1. Assume the risk-free return is R = 1.05. (a) Plot the minimum variance set. (b) Use the fact that the Sharpe ratio is maximized at the tangency portfolio to show that the tangency portfolio has the following form: (R R) (1p) (R- R) - (1-p) (R-R+R- R) W = 1-W1 (c) Find the numerical value of tangency portfolio (1, 2). Does short-selling happen? Explain your results. If no short-selling is allowed, what is the tangency portfolio? (d) Suppose R = 1.25. What is the tangency portfolio? Does it make any sense? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts