Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a risk-averse investor whose preferences can be represented by the following utility function: U = E(W) - VAR(W), where W is

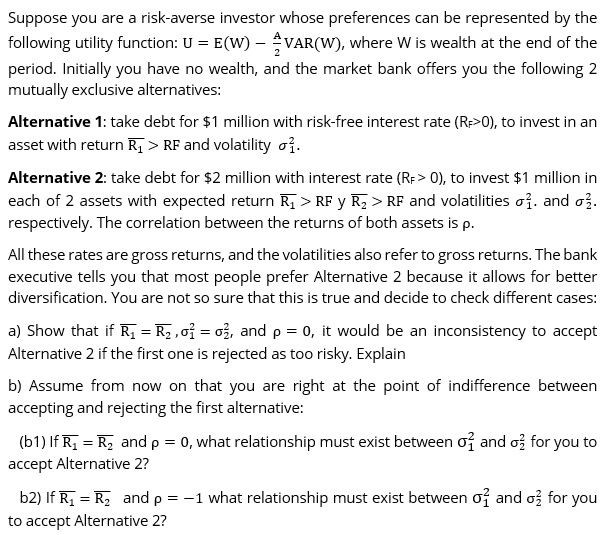

Suppose you are a risk-averse investor whose preferences can be represented by the following utility function: U = E(W) - VAR(W), where W is wealth at the end of the period. Initially you have no wealth, and the market bank offers you the following 2 mutually exclusive alternatives: Alternative 1: take debt for $1 million with risk-free interest rate (R->0), to invest in an asset with return R > RF and volatility . Alternative 2: take debt for $2 million with interest rate (R=> 0), to invest $1 million in each of 2 assets with expected return R > RF y R > RF and volatilities 1. and . respectively. The correlation between the returns of both assets is p. All these rates are gross returns, and the volatilities also refer to gross returns. The bank executive tells you that most people prefer Alternative 2 because it allows for better diversification. You are not so sure that this is true and decide to check different cases: a) Show that if R = R, = , and p = 0, it would be an inconsistency to accept Alternative 2 if the first one is rejected as too risky. Explain b) Assume from now on that you are right at the point of indifference between accepting and rejecting the first alternative: (b1) If R = R2 and p = 0, what relationship must exist between and for you to accept Alternative 2? b2) If R = R and p = -1 what relationship must exist between and for you to accept Alternative 2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a If overline R1overline R2sigma 12sigma 22 and ho 0 it would be an inconsistency to accept ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started