Question: Swear this is one question, its long, I am sorry. For the journal entry ignore the 5s -- I put them there as place holders

![below.] Stark company has the following adjusted accounts and balances at its](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fba48e86603_69466fba48e2869b.jpg)

Swear this is one question, its long, I am sorry. For the journal entry ignore the 5s -- I put them there as place holders so you could see the journal as a whole and not parts.

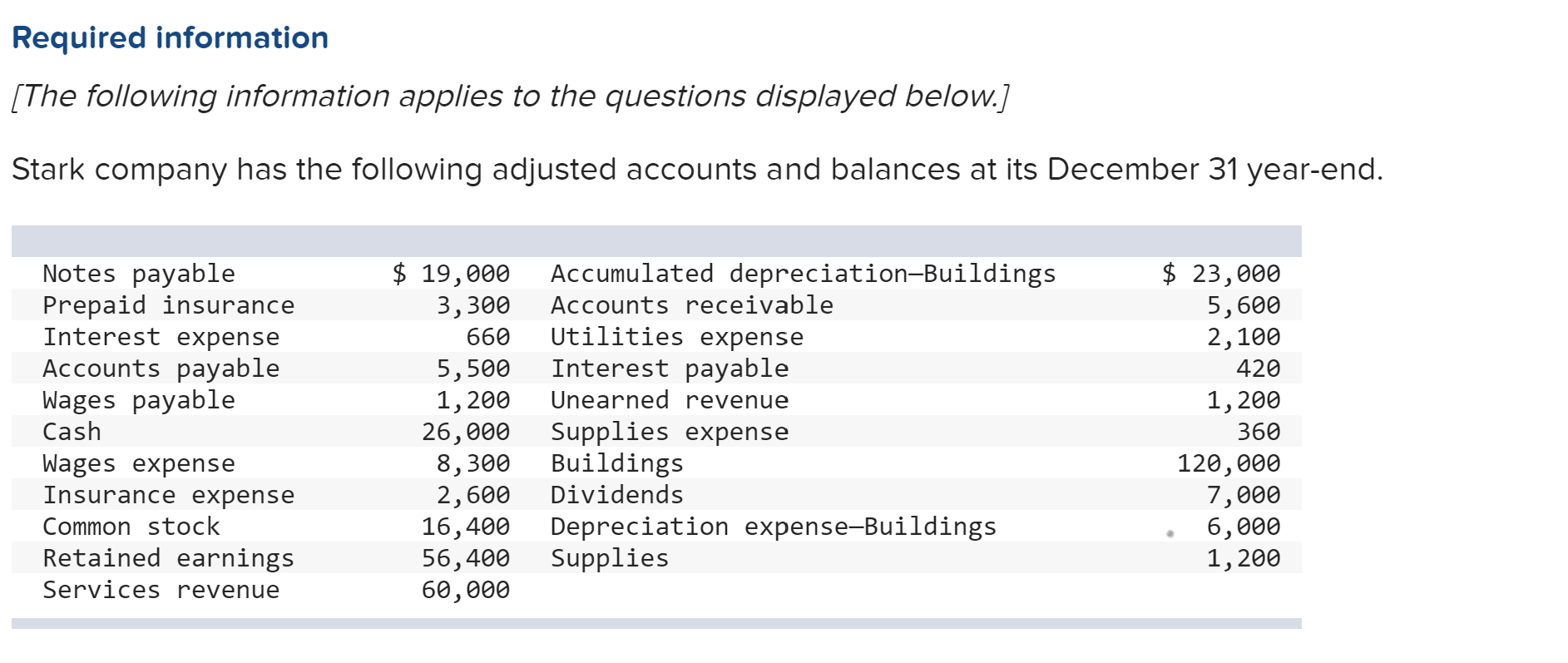

Required information [The following information applies to the questions displayed below.] Stark company has the following adjusted accounts and balances at its December 31 year-end. Notes payable Prepaid insurance Interest expense Accounts payable Wages payable Cash Wages expense Insurance expense Common stock Retained earnings Services revenue $ 19,000 3,300 660 5,500 1,200 26,000 8,300 2,600 16,400 56,400 60,000 Accumulated depreciation-Buildings Accounts receivable Utilities expense Interest payable Unearned revenue Supplies expense Buildings Dividends Depreciation expense-Buildings Supplies $ 23,000 5,600 2,100 420 1,200 360 120,000 7,000 6,000 1,200 Use the adjusted trial balance accounts and balances at its December 31 year-end for Stark Company to prepare an adjusted trial balance. STARK COMPANY Adjusted Trial Balance December 31 Debit Credit Totals $ 0 $ 0 Prepare the income statement for the year ended December 31. STARK COMPANY Income Statement For Year Ended December 31 Expenses Total expenses 0 $ 0 STARK COMPANY Statement of Retained Earnings For Year Ended December 31 Retained earnings, Dec. 31 prior year end 0 Retained earnings, Dec. 31 current year end $ $ 0 STARK COMPANY Balance Sheet December 31 Assets 0 Total assets $ 0 Liabilities Total liabilities 0 Equity 0 Total equity Total liabilities and equity 100 $ 0 View transaction list View journal entry worksheet No Transaction Account Title Debit Credit 1 1 5 5 N N 5 5 3 3 5 5 4 4 5 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts