Question: swer questions. Points are listed for each question. Explain how you would use Value at Risk (VAR) as a way to measure market risk. Also

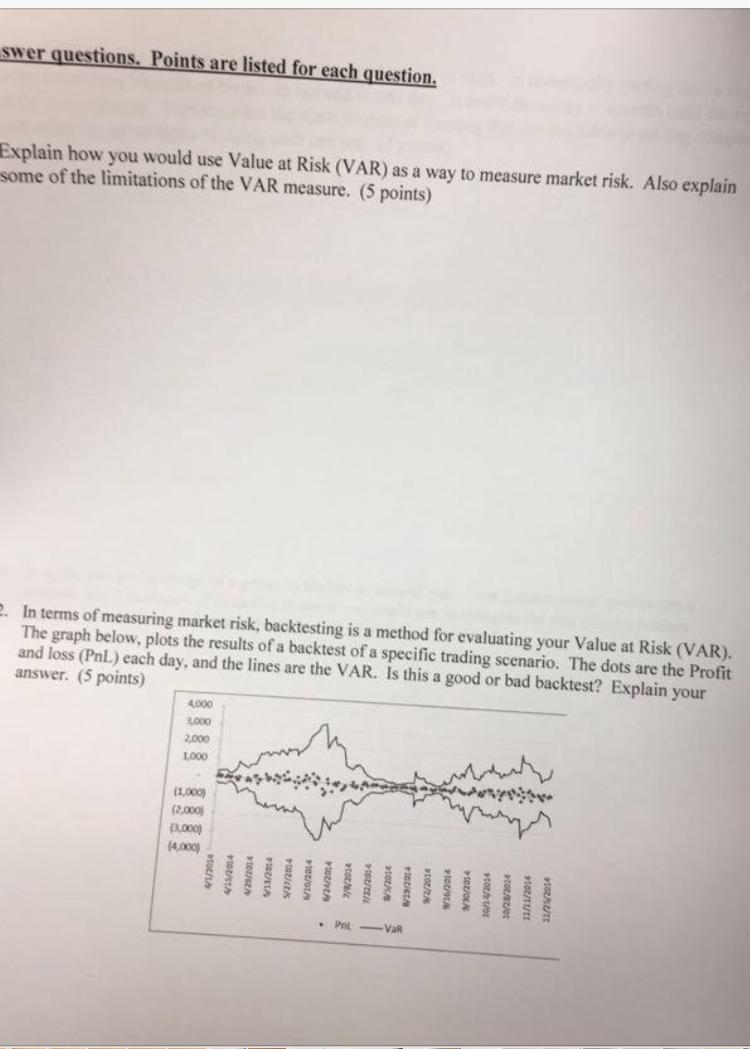

swer questions. Points are listed for each question. Explain how you would use Value at Risk (VAR) as a way to measure market risk. Also explain some of the limitations of the VAR measure. (5 points) In terms of measuring market risk, backtesting is a method for evaluating your Value at Risk (VAR). The graph below, plots the results of a backtest of a specific trading scenario. The dots are the Profit and loss (PnL.) each day, and the lines are the VAR. Is this a good or bad backtest? Explain your answer. (5 points) 4000 2.000 1000 (1,000) 12,000 (4.030) 412034 42/2014 6710/2314 916/2014 By 30/2014 10/2 4/2014 16/2872014 12/1/3014 13/25/2014 Phil -VIA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts