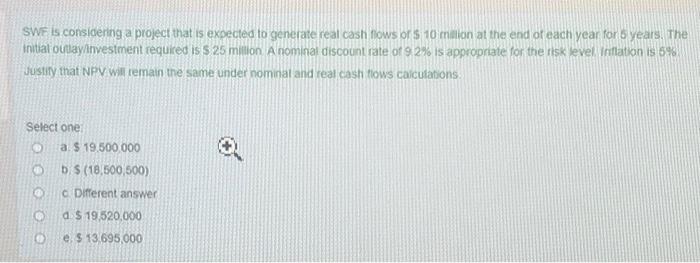

Question: SWF is considering a project that is expected to generate real cash flows or $ 10 milion at the end of each year for years.

SWF is considering a project that is expected to generate real cash flows or $ 10 milion at the end of each year for years. The Initial outlayinvestment required is 525 million A nominal discount rate of 92% is appropriate for the risk level iritation 19 69 Justry that NPV will remain the same under nominal and real cash flows calculations Select one a $ 19.500.000 D/S (18,500,500) c Different answer a $ 19,520,000 e s 13695,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts