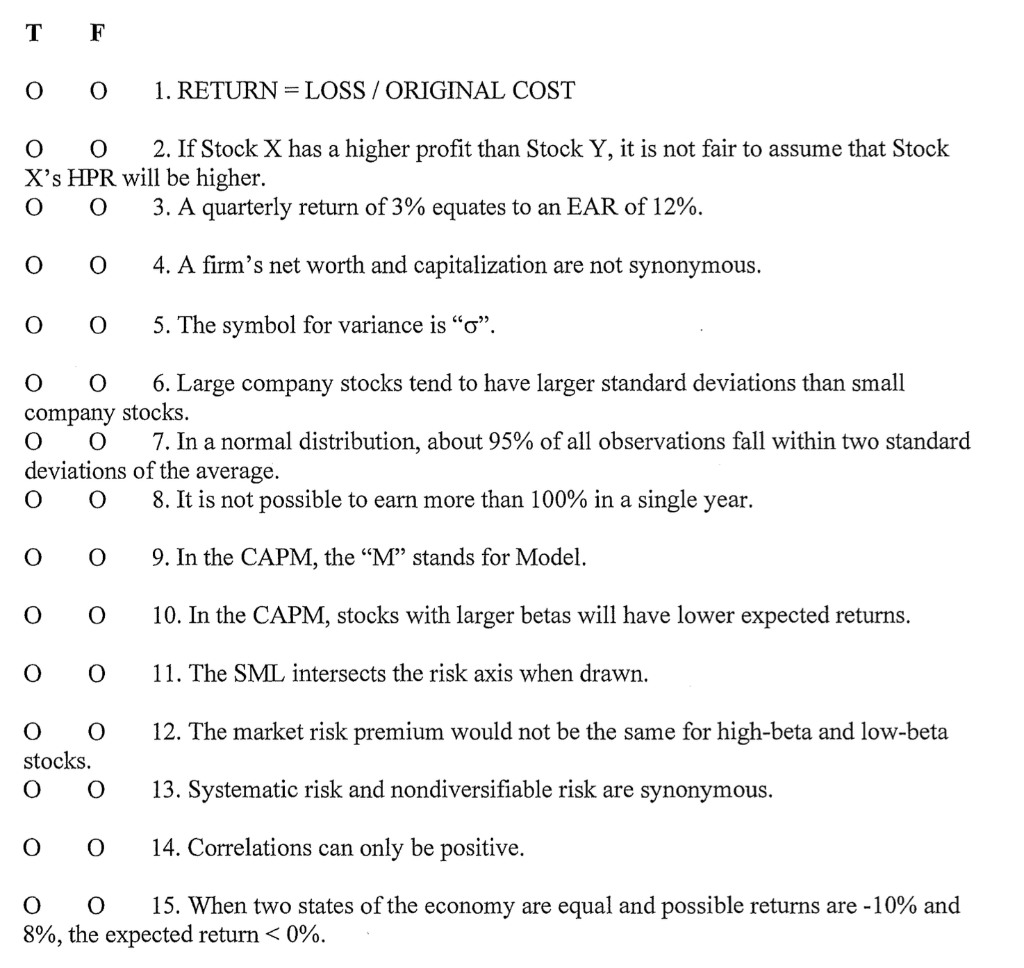

Question: T F 0 0 1. RETURN = LOSS / ORIGINAL COST 0 0 2. If Stock X has a higher profit than Stock Y, it

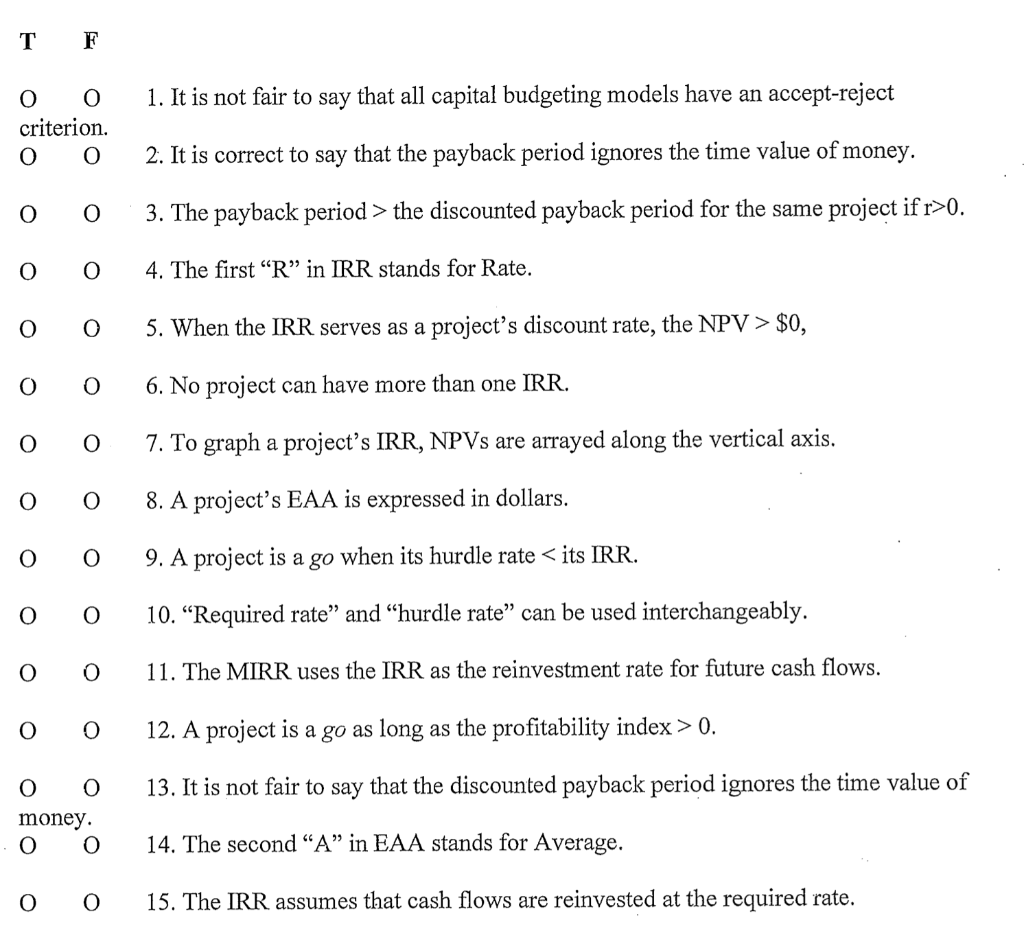

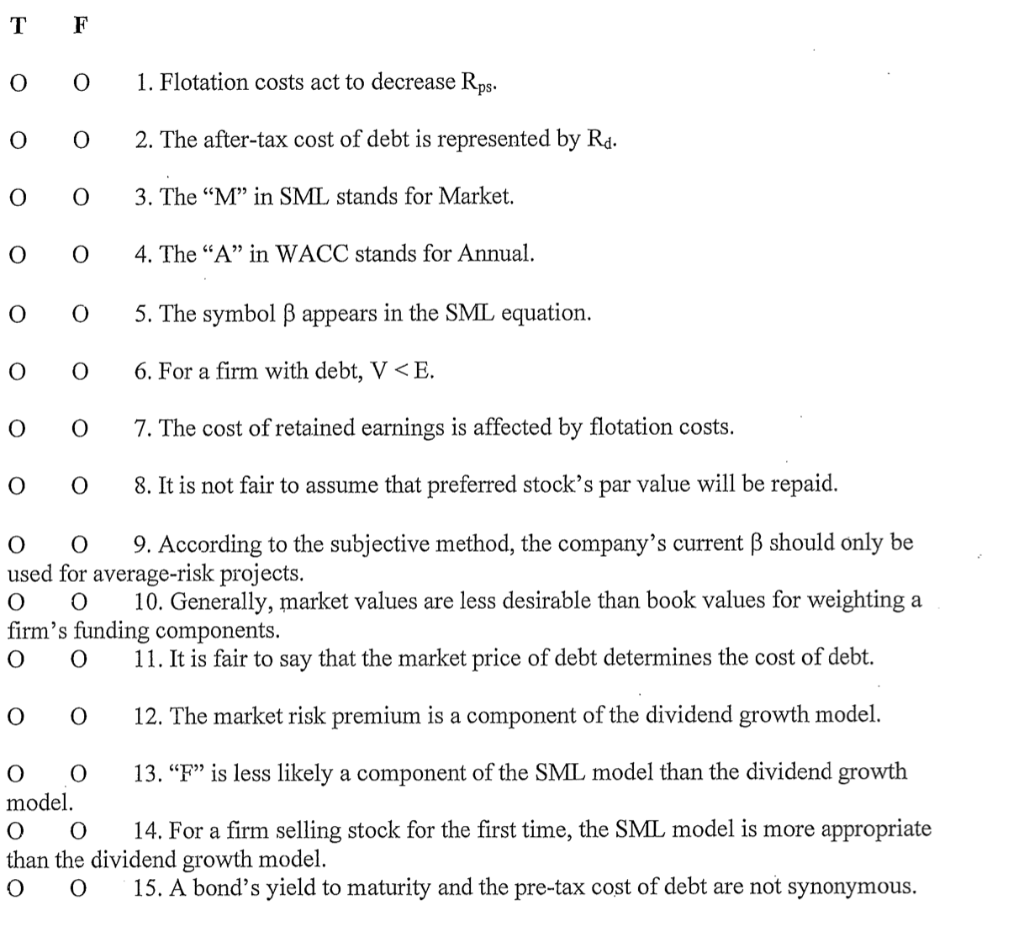

T F 0 0 1. RETURN = LOSS / ORIGINAL COST 0 0 2. If Stock X has a higher profit than Stock Y, it is not fair to assume that Stock X's HPR will be higher. 3. A quarterly return of 3% equates to an EAR of 12%. 0 4. A firm's net worth and capitalization are not synonymous. 0 0 5. The symbol for variance is o. 0 0 6. Large company stocks tend to have larger standard deviations than small company stocks. 0 0 7. In a normal distribution, about 95% of all observations fall within two standard deviations of the average. 0 0 8. It is not possible to earn more than 100% in a single year. 0 0 9. In the CAPM, the M stands for Model. 0 0 10. In the CAPM, stocks with larger betas will have lower expected returns. 0 0 0 0 stocks. 0 0 11. The SML intersects the risk axis when drawn. 12. The market risk premium would not be the same for high-beta and low-beta 13. Systematic risk and nondiversifiable risk are synonymous. 0 0 14. Correlations can only be positive. 0 0 15. When two states of the economy are equal and possible returns are -10% and 8%, the expected return the discounted payback period for the same project ifr>0. 4. The first R in IRR stands for Rate. 0 0 5. When the IRR serves as a project's discount rate, the NPV> $0, O 0 6. No project can have more than one IRR. O 0 0 7. To graph a project's IRR, NPVs are arrayed along the vertical axis. 0 0 8. A project's EAA is expressed in dollars. 0 9 . A project is a go when its hurdle rate 0. 13. It is not fair to say that the discounted payback period ignores the time value of money. 0 14. The second A in EAA stands for Average. 0 0 15. The IRR assumes that cash flows are reinvested at the required rate. T 0 0 0 0 0 0 F 0 0 0 0 0 0 O 1. Flotation costs act to decrease Rps. 2. The after-tax cost of debt is represented by Rd. 3. The M in SML stands for Market. 4. The A in WACC stands for Annual. 5. The symbol appears in the SML equation. 6. For a firm with debt, V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts