Question: True False O O 1. RETURN = LOSS / ORIGINAL COST O Q 0 O o 0 2. If Stock X has a higher profit

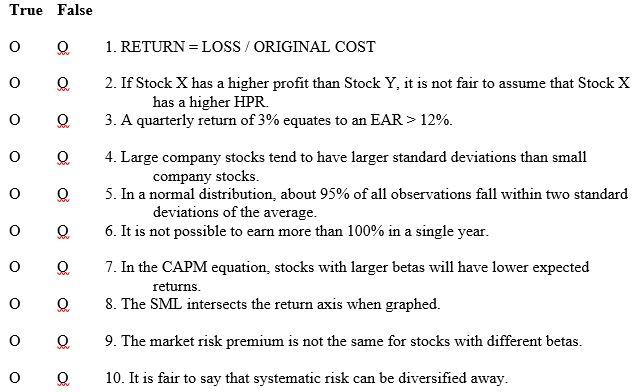

True False O O 1. RETURN = LOSS / ORIGINAL COST O Q 0 O o 0 2. If Stock X has a higher profit than Stock Y, it is not fair to assume that Stock X has a higher HPR 3. A quarterly return of 3% equates to an EAR > 12%. 4. Large company stocks tend to have larger standard deviations than small company stocks. 5. In a normal distribution about 95% of all observations fall within two standard deviations of the average. 6. It is not possible to earn more than 100% in a single year. O O O O O O 7. In the CAPM equation, stocks with larger betas will have lower expected returns. 8. The SML intersects the return axis when graphed. 0 Q o 0 9. The market risk premium is not the same for stocks with different betas. 10. It is fair to say that systematic risk can be diversified away. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts