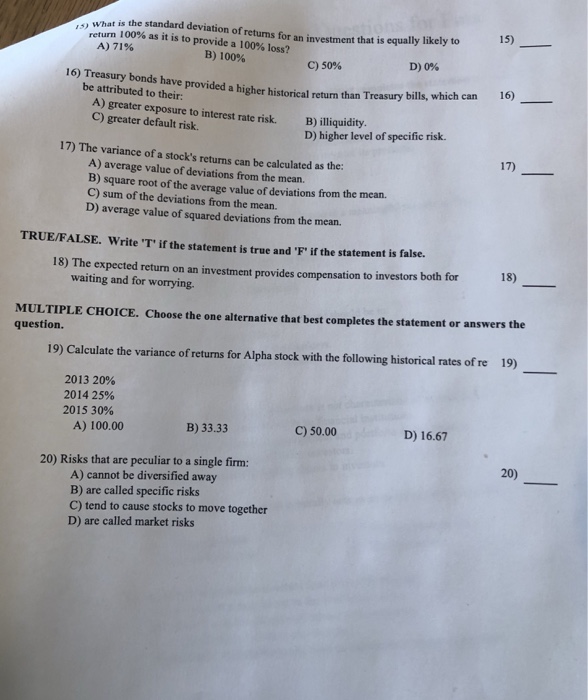

Question: t is the standard deviation of returns for return 100% as it is to provide a 100% loss? 15) an investment that is equally likely

t is the standard deviation of returns for return 100% as it is to provide a 100% loss? 15) an investment that is equally likely to A) 71% B) 100% D) 0% C) 50% 16) Treasury bonds have provided a higher historical return than Treasury bills. which can 16) be attributed to their: A) greater exposure to interest rate risk. B) lliquidity. C) greater default risk. D) higher level of specific risk. 17) The variance of a stock's returns can be calculated as the: 17) A) average value of deviations from the mean. B) square root of the average value of deviations from the mean. C) sum of the deviations from the mean. D) average value of squared deviations from the mean. TRUE/FALSE. Write T if the statement is true and 'F" if the statement is false. 18) 18) The expected return on an investment provides compensation to investors both for waiting and for worrying. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question 19) 19) Calculate the variance of returns for Alpha stock with the following historical rates of re 2013 20% 2014 25% 2015 30% A) 100.00 B) 33.33 C) 50.00 D) 16.67 20) Risks that are peculiar to a single firm 20) A) cannot be diversified away B) are called specific risks C) tend to cause stocks to move together D) are called market risks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts