Question: Table 1 below reports the present values (in E million) of different investment projects at different interest rates in the future (a) Calculate the expected

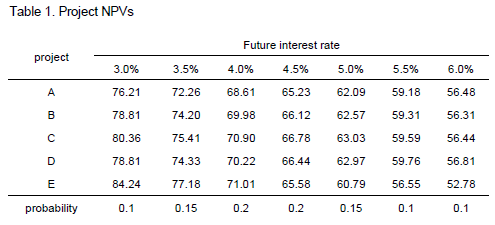

Table 1 below reports the present values (in E million) of different investment projects at different interest rates in the future

(a) Calculate the expected present value of each project. Which project maximises the expected value? Why would you choose to proceed with this one?

(b) Calculate the maximin and the maximax criteria.

(c) Calculate the minimax regret criterion. When would this criterion be applied?

(d) Calculate the expected value of perfect information. What does it describe?

Table 1. Project NPVs Future interest rate project 3.0% 76.21 78.81 80.36 78.81 84.24 0.1 4.0% 5.0% 3.5% 72.26 68.61 65.23 62.09 59.18 56.48 74.20 69.98 66.12 6257 59.31 56.31 75.41 74.33 70.22 66.44 62.97 59.76 56.81 77.18 7101 65.58 60.79 56.55 52.78 0.15 4.5% 5.5% 6.0% 70.90 66.78 63.03 59.59 56.44 probability 0.2 0.2 0.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts