Question: Table 1 Fig. 2. The optimal portfolio weights on nominal bonds, stocks, indexed bonds, and cash with T=40,T=60, and g=10. The coefficient of relative risk

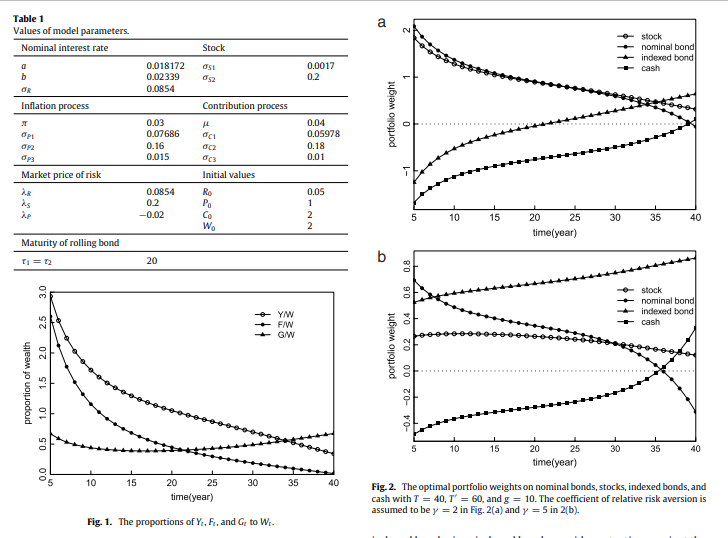

Table 1 Fig. 2. The optimal portfolio weights on nominal bonds, stocks, indexed bonds, and cash with T=40,T=60, and g=10. The coefficient of relative risk aversion is assumed to be y=2 in Fig. 2(a) and y=5 in 2(b). Fig. 1. The proportions of Yt,Ft, and Gt to Wt- Table 1 Fig. 2. The optimal portfolio weights on nominal bonds, stocks, indexed bonds, and cash with T=40,T=60, and g=10. The coefficient of relative risk aversion is assumed to be y=2 in Fig. 2(a) and y=5 in 2(b). Fig. 1. The proportions of Yt,Ft, and Gt to Wt-

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts