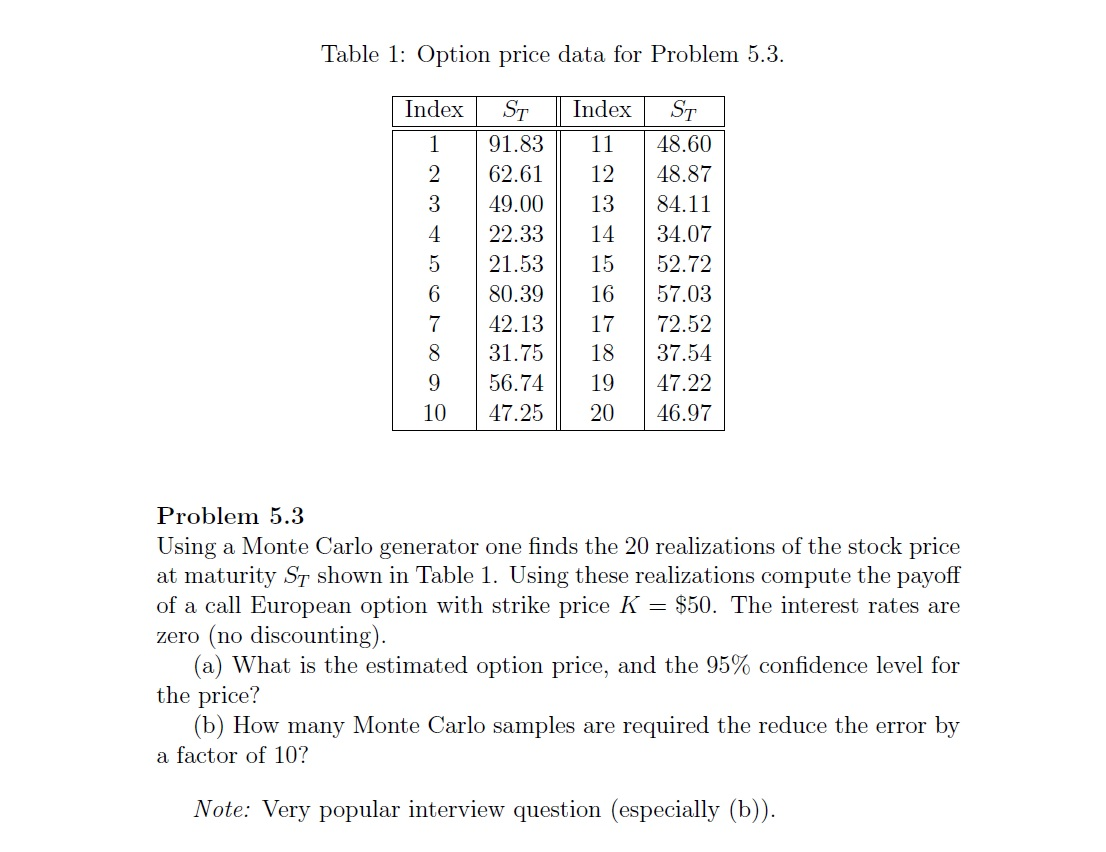

Question: Table 1: Option price data for Problem 5.3. Index Index 11 SoovCT A CON ST 91.83 62.61 49.00 22.33 21.53 80.39 42.13 31.75 56.74 47.25

Table 1: Option price data for Problem 5.3. Index Index 11 SoovCT A CON ST 91.83 62.61 49.00 22.33 21.53 80.39 42.13 31.75 56.74 47.25 St 48.60 48.87 84.11 34.07 52.72 57.03 72.52 37.54 47.22 46.97 18 19 Problem 5.3 Using a Monte Carlo generator one finds the 20 realizations of the stock price at maturity St shown in Table 1. Using these realizations compute the payoff of a call European option with strike price K = $50. The interest rates are zero (no discounting). (a) What is the estimated option price, and the 95% confidence level for the price? (b) How many Monte Carlo samples are required the reduce the error by a factor of 10? Note: Very popular interview question (especially (b)). Table 1: Option price data for Problem 5.3. Index Index 11 SoovCT A CON ST 91.83 62.61 49.00 22.33 21.53 80.39 42.13 31.75 56.74 47.25 St 48.60 48.87 84.11 34.07 52.72 57.03 72.52 37.54 47.22 46.97 18 19 Problem 5.3 Using a Monte Carlo generator one finds the 20 realizations of the stock price at maturity St shown in Table 1. Using these realizations compute the payoff of a call European option with strike price K = $50. The interest rates are zero (no discounting). (a) What is the estimated option price, and the 95% confidence level for the price? (b) How many Monte Carlo samples are required the reduce the error by a factor of 10? Note: Very popular interview question (especially (b))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts