Question: TABLE TOOLS inal exam Question Term 1220 ACC T20073 [Compatibility Mode] - Word PAGE LAYOUT REFERENCES MAILINGS REVIEW VIEW EndNote X9 DESIGN LAYOUT ABECED& AaBbccIX

![TABLE TOOLS inal exam Question Term 1220 ACC T20073 [Compatibility Mode]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e74d80d1bd1_68866e74d803b6c1.jpg)

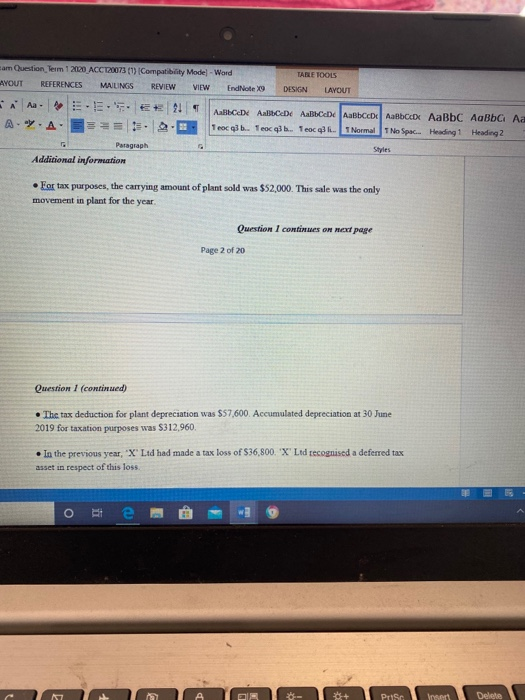

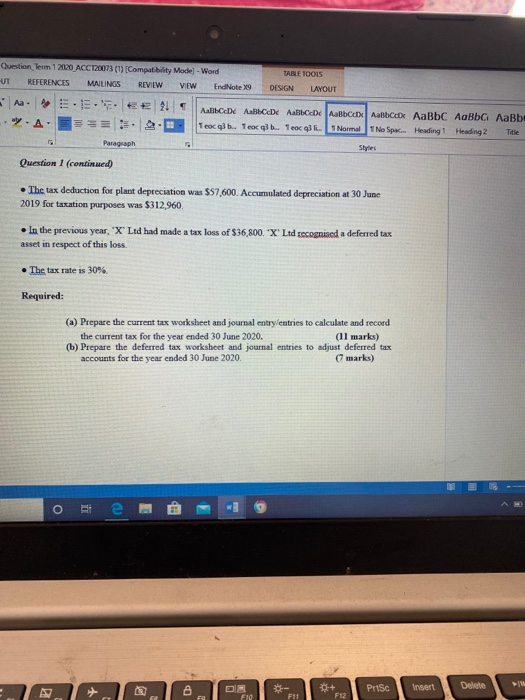

TABLE TOOLS inal exam Question Term 1220 ACC T20073 [Compatibility Mode] - Word PAGE LAYOUT REFERENCES MAILINGS REVIEW VIEW EndNote X9 DESIGN LAYOUT ABECED& AaBbccIX AaBbceDc Aabbccc AabbCcDx AaBbc AaBbc Tocq3 b... Teocab. Teacq3. Normal 1 No Spac... Heading Heading 2 A--A ant Paragraph Styles 18 Marks Question 1 'X' Ltd has determined its accounting profit before tax for the year ended 30 June 2020 to be $133.440. Included in this profit are the items of revenue and expense shown below. Doubtful debts expense Depreciation expense plant Insurance expense Annual leave expense Government grant (non-taxable) Entertainment expense (non-deductible) Gain on sale of plant $ 16,200 $ 48,000 $ 25,800 S 30,800 $ 11,000 S 16,400 $ 6,000 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Accounts receivable Allowance for doubtful debts Prepaid insurance Plant Accumulated depreciation - plant Deferred tax asset Provision for annual leave Deferred tax liability 2020 $312,000 S (13,600) $ 6,800 $ 480,000 S (268,800) 2019 $295,000 S (10,400) $ 11,200 S 580.000 S(260,800) $ 19,980 $ 19,400 $ 19,008 $ 28,200 Additional information O Cam Question Term 1 2020 ACCT20073 (1) Compatibility Mode - Word AYOUT REFERENCES MAILINGS REVIEW VIEW EndNote X TABLE TOOLS DESIGN LAYOUT - AAE ET ET ABCD Aalt.C.De AaBbceDe AaBbcc AalbCX AaBbc AaBb Aa A.A.EE Teocal b... Teach... Teacq. 1 Normal 1 No Space Heading 1 Heading 2 Paragraph Styles Additional information For tax purposes, the carrying amount of plant sold was $52,000. This sale was the only movement in plant for the year Question I continues on next page Page 2 of 20 Question 1 (continued) The tax deduction for plant depreciation was $57,600. Accumulated depreciation at 30 June 2019 for taxation purposes was $312,960 In the previous year, X Ltd had made a tax loss of S36,800.X Ltd recognised a deferred tax asset in respect of this loss. O 30+ Prisc Delete Question Term 1 2120 AC120073 (1) Compatibility Mode] - Word UT REFERENCES MALINIS REVIEW VIEW EndNote X9 TABLE TOOLS DESIGN LAYOUT Aa- E.EE215 ..A Paragraph AHD, ANH CcDc Ca Icloc abc abcx AaBbc AaBb AaBb Teocal b. Teacq3 b... Teocelli 1 Normal 1 No Spec. Heading 1 Heading 2 Title Styles Question 1 (continued) The tax deduction for plant depreciation was $57,600. Accumulated depreciation at 30 June 2019 for taxation purposes was $312,960 In the previous year, 'X Ltd had made a tax loss of $36,800. 'X' Ltd recognised a deferred tax asset in respect of this loss. The tax rate is 30% Required: (a) Prepare the current tax worksheet and journal entry/entries to calculate and record the current tax for the year ended 30 June 2020. (11 marks) (b) Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts for the year ended 30 June 2020 (marks) + Prusc Delete DP Insert F10 F11 F12 TABLE TOOLS inal exam Question Term 1220 ACC T20073 [Compatibility Mode] - Word PAGE LAYOUT REFERENCES MAILINGS REVIEW VIEW EndNote X9 DESIGN LAYOUT ABECED& AaBbccIX AaBbceDc Aabbccc AabbCcDx AaBbc AaBbc Tocq3 b... Teocab. Teacq3. Normal 1 No Spac... Heading Heading 2 A--A ant Paragraph Styles 18 Marks Question 1 'X' Ltd has determined its accounting profit before tax for the year ended 30 June 2020 to be $133.440. Included in this profit are the items of revenue and expense shown below. Doubtful debts expense Depreciation expense plant Insurance expense Annual leave expense Government grant (non-taxable) Entertainment expense (non-deductible) Gain on sale of plant $ 16,200 $ 48,000 $ 25,800 S 30,800 $ 11,000 S 16,400 $ 6,000 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Accounts receivable Allowance for doubtful debts Prepaid insurance Plant Accumulated depreciation - plant Deferred tax asset Provision for annual leave Deferred tax liability 2020 $312,000 S (13,600) $ 6,800 $ 480,000 S (268,800) 2019 $295,000 S (10,400) $ 11,200 S 580.000 S(260,800) $ 19,980 $ 19,400 $ 19,008 $ 28,200 Additional information O Cam Question Term 1 2020 ACCT20073 (1) Compatibility Mode - Word AYOUT REFERENCES MAILINGS REVIEW VIEW EndNote X TABLE TOOLS DESIGN LAYOUT - AAE ET ET ABCD Aalt.C.De AaBbceDe AaBbcc AalbCX AaBbc AaBb Aa A.A.EE Teocal b... Teach... Teacq. 1 Normal 1 No Space Heading 1 Heading 2 Paragraph Styles Additional information For tax purposes, the carrying amount of plant sold was $52,000. This sale was the only movement in plant for the year Question I continues on next page Page 2 of 20 Question 1 (continued) The tax deduction for plant depreciation was $57,600. Accumulated depreciation at 30 June 2019 for taxation purposes was $312,960 In the previous year, X Ltd had made a tax loss of S36,800.X Ltd recognised a deferred tax asset in respect of this loss. O 30+ Prisc Delete Question Term 1 2120 AC120073 (1) Compatibility Mode] - Word UT REFERENCES MALINIS REVIEW VIEW EndNote X9 TABLE TOOLS DESIGN LAYOUT Aa- E.EE215 ..A Paragraph AHD, ANH CcDc Ca Icloc abc abcx AaBbc AaBb AaBb Teocal b. Teacq3 b... Teocelli 1 Normal 1 No Spec. Heading 1 Heading 2 Title Styles Question 1 (continued) The tax deduction for plant depreciation was $57,600. Accumulated depreciation at 30 June 2019 for taxation purposes was $312,960 In the previous year, 'X Ltd had made a tax loss of $36,800. 'X' Ltd recognised a deferred tax asset in respect of this loss. The tax rate is 30% Required: (a) Prepare the current tax worksheet and journal entry/entries to calculate and record the current tax for the year ended 30 June 2020. (11 marks) (b) Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts for the year ended 30 June 2020 (marks) + Prusc Delete DP Insert F10 F11 F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts