Question: Target Case (Static) Part 1 and 3 Required: 3. Calculate the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Targets ratios

Target Case (Static) Part 1 and 3

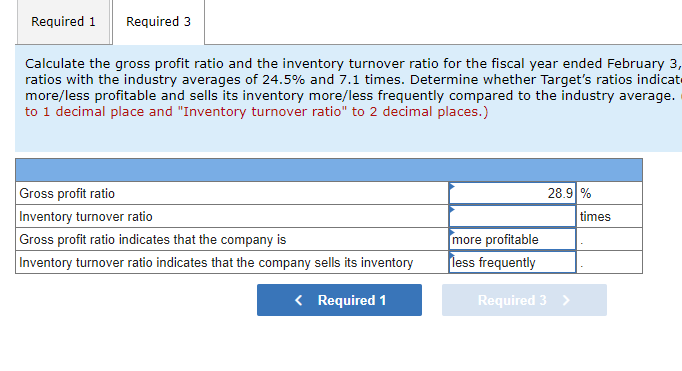

Required: 3. Calculate the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Targets ratios with the industry averages of 24.5% and 7.1 times. Determine whether Targets ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average.

Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3 ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indica more/less profitable and sells its inventory more/less frequently compared to the industry average. to 1 decimal place and "Inventory turnover ratio" to 2 decimal places.) Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3 ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indica more/less profitable and sells its inventory more/less frequently compared to the industry average. to 1 decimal place and "Inventory turnover ratio" to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts