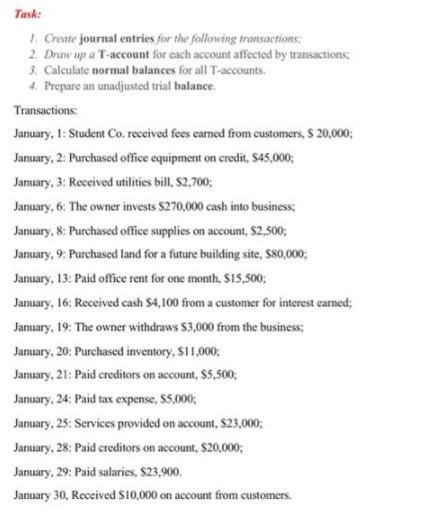

Question: Task: 1. Create journal entries for the following transactions; 2. Druw up a T-account for cach account affected by transactions, 3. Calculate normal balances

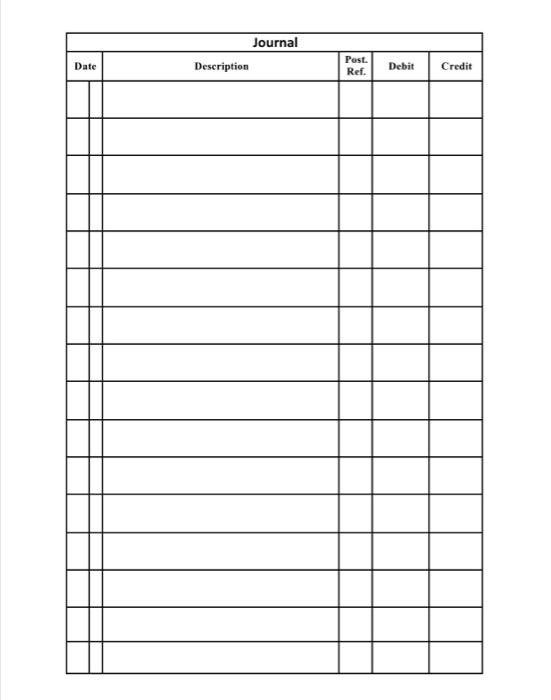

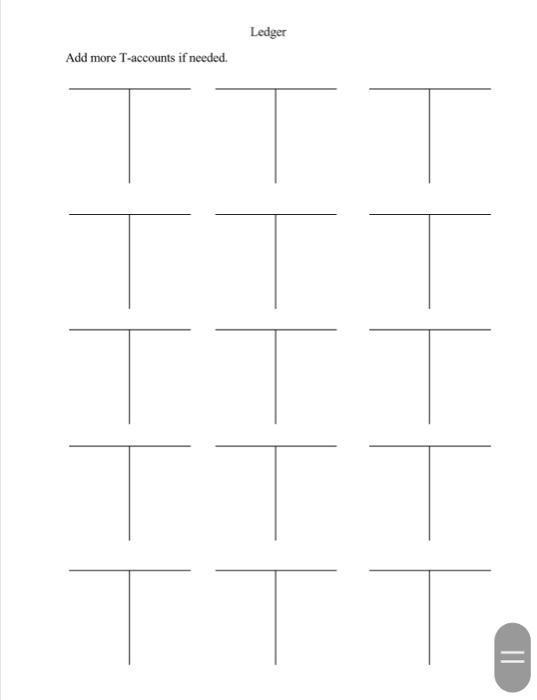

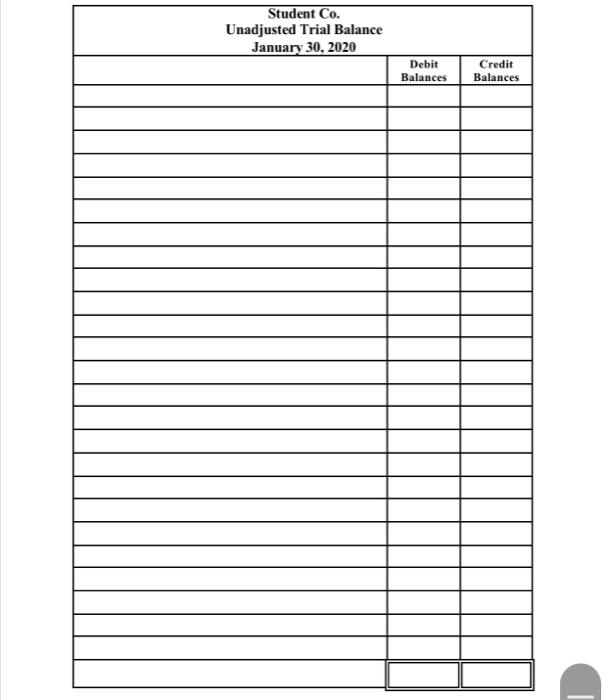

Task: 1. Create journal entries for the following transactions; 2. Druw up a T-account for cach account affected by transactions, 3. Calculate normal balances for all T-accounts. 4. Prepare an unadjusted trial balance. Transactions: January, 1: Student Co. received fees earned from customers, $ 20,000; January, 2: Purchased office equipment on credit, $45,000; January, 3: Received utilities bill, $2,700; January, 6: The owner invests $270,000 cash into business; January, 8: Purchased office supplies on account, $2,500; January, 9: Purchased land for a future building site, S80,000; January, 13: Paid office rent for one month, $15,500; January, 16: Received cash $4,100 from a customer for interest earned; January, 19: The owner withdraws $3,000 from the business; January, 20: Purchased inventory, $11,000; January, 21: Paid creditors on account, $5,500; January, 24: Paid tax expense, S5,000; January, 25: Services provided on account, $23,000; January, 28: Paid creditors on account, $20,000; January, 29: Paid salaries, $23,900. January 30, Rececived S10,000 on account from customers. Journal Post. Date Description Debit Credit Ref. Ledger Add more T-accounts if needed. || Student Co. Unadjusted Trial Balance January 30, 2020 Debit Credit Balances Balances Task: 1. Create journal entries for the following transactions; 2. Druw up a T-account for cach account affected by transactions, 3. Calculate normal balances for all T-accounts. 4. Prepare an unadjusted trial balance. Transactions: January, 1: Student Co. received fees earned from customers, $ 20,000; January, 2: Purchased office equipment on credit, $45,000; January, 3: Received utilities bill, $2,700; January, 6: The owner invests $270,000 cash into business; January, 8: Purchased office supplies on account, $2,500; January, 9: Purchased land for a future building site, S80,000; January, 13: Paid office rent for one month, $15,500; January, 16: Received cash $4,100 from a customer for interest earned; January, 19: The owner withdraws $3,000 from the business; January, 20: Purchased inventory, $11,000; January, 21: Paid creditors on account, $5,500; January, 24: Paid tax expense, S5,000; January, 25: Services provided on account, $23,000; January, 28: Paid creditors on account, $20,000; January, 29: Paid salaries, $23,900. January 30, Rececived S10,000 on account from customers. Journal Post. Date Description Debit Credit Ref. Ledger Add more T-accounts if needed. || Student Co. Unadjusted Trial Balance January 30, 2020 Debit Credit Balances Balances Task: 1. Create journal entries for the following transactions; 2. Druw up a T-account for cach account affected by transactions, 3. Calculate normal balances for all T-accounts. 4. Prepare an unadjusted trial balance. Transactions: January, 1: Student Co. received fees earned from customers, $ 20,000; January, 2: Purchased office equipment on credit, $45,000; January, 3: Received utilities bill, $2,700; January, 6: The owner invests $270,000 cash into business; January, 8: Purchased office supplies on account, $2,500; January, 9: Purchased land for a future building site, S80,000; January, 13: Paid office rent for one month, $15,500; January, 16: Received cash $4,100 from a customer for interest earned; January, 19: The owner withdraws $3,000 from the business; January, 20: Purchased inventory, $11,000; January, 21: Paid creditors on account, $5,500; January, 24: Paid tax expense, S5,000; January, 25: Services provided on account, $23,000; January, 28: Paid creditors on account, $20,000; January, 29: Paid salaries, $23,900. January 30, Rececived S10,000 on account from customers. Journal Post. Date Description Debit Credit Ref. Ledger Add more T-accounts if needed. || Student Co. Unadjusted Trial Balance January 30, 2020 Debit Credit Balances Balances Task: 1. Create journal entries for the following transactions; 2. Druw up a T-account for cach account affected by transactions, 3. Calculate normal balances for all T-accounts. 4. Prepare an unadjusted trial balance. Transactions: January, 1: Student Co. received fees earned from customers, $ 20,000; January, 2: Purchased office equipment on credit, $45,000; January, 3: Received utilities bill, $2,700; January, 6: The owner invests $270,000 cash into business; January, 8: Purchased office supplies on account, $2,500; January, 9: Purchased land for a future building site, S80,000; January, 13: Paid office rent for one month, $15,500; January, 16: Received cash $4,100 from a customer for interest earned; January, 19: The owner withdraws $3,000 from the business; January, 20: Purchased inventory, $11,000; January, 21: Paid creditors on account, $5,500; January, 24: Paid tax expense, S5,000; January, 25: Services provided on account, $23,000; January, 28: Paid creditors on account, $20,000; January, 29: Paid salaries, $23,900. January 30, Rececived S10,000 on account from customers. Journal Post. Date Description Debit Credit Ref. Ledger Add more T-accounts if needed. || Student Co. Unadjusted Trial Balance January 30, 2020 Debit Credit Balances Balances

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Journal Entry Date Description Post Ref Debit Credit 010122 Cash Ac Dr 20000 To Customer Ac 20000 Being fees earned 020122 Office Equipment Ac Dr 45000 To Creditor Ac 45000 Being equipment purchased 0... View full answer

Get step-by-step solutions from verified subject matter experts