Question: Task 2: (10 marks) ICAD has invested in a fixed rate bond that has a coupon rate of 10%. The maturity of the bond is

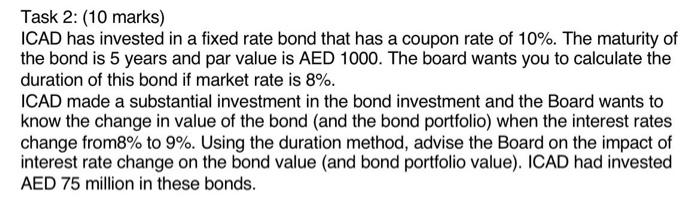

Task 2: (10 marks) ICAD has invested in a fixed rate bond that has a coupon rate of 10%. The maturity of the bond is 5 years and par value is AED 1000. The board wants you to calculate the duration of this bond if market rate is 8%. ICAD made a substantial investment in the bond investment and the Board wants to know the change in value of the bond (and the bond portfolio) when the interest rates change from 8% to 9%. Using the duration method, advise the Board on the impact of interest rate change on the bond value (and bond portfolio value). ICAD had invested AED 75 million in these bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock