Question: Task Details: (R&D) project in July 2017 to modify the method of recharging batteries used in its products. The project was successfully completed in June

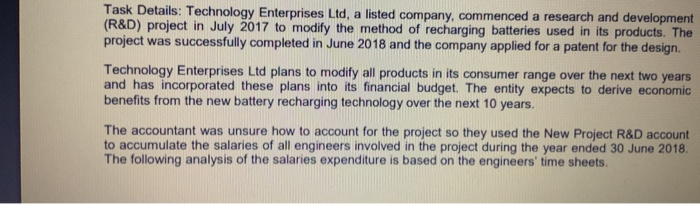

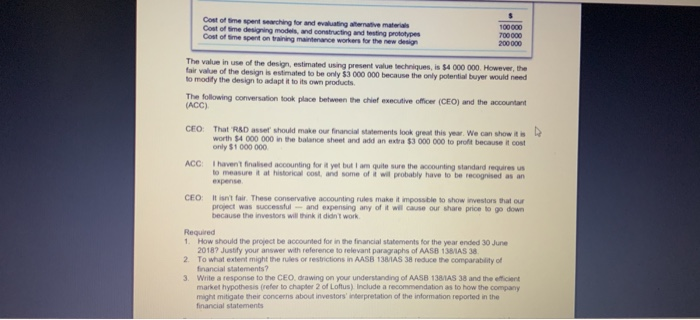

Task Details: (R&D) project in July 2017 to modify the method of recharging batteries used in its products. The project was successfully completed in June 2018 and the company applied for a patent for the design Technology Enterprises Ltd, a listed company, commenced a research and development Technology Enterprises Ltd plans to modify all products in its consumer range over the next two years and has incorporated these plans into its financial budget. The entity expects to derive economic benefits from the new battery recharging technology over the next 10 years. The accountant was unsure how to account for the project so they used the New Project R&D account to accumulate the salaries of all engineers involved in the project during the year ended 30 June 2018 The following analysis of the salaries expenditure is based on the engineers' time sheets Cost of time spent searching for and evaluating aermative materias Cost of time designing models, and constructing and testing prototypes Cost of time spent on training maintenance workers for the new desig 700000 200000 The value in use of the design, fair value of estimated using present value techniques, is $4 000 000. However, the would need o modity the design to adapt it to its own products The following conversation took place between the chief executive officer (CEO) and the accountant (ACC) CEO That worth $4 000 000 in the balance sheet and add an extra $3 000 000 to profit because it cost only $1 000 000 R&D assef should make our financial statements look great this year. We can show its ACC haven't firalsed accounting tor to measure it at historical cost and some of it wil probably have to be recognised as an but ' am quite sure the accountrg standard reo." u expense CEO It isn't fair. These conservative accounting rules make it impossble to show investors that our project was successful-and expensing any of it will cause our share price to go down because the investors will think it didnt work Required 1. How should the project be accounted for in the financial stabements for the year ended 30 June 2 To what extent might the ruies or restrictions in AASB 138AS 38 reduce the comparablity of 3 Write a response to the CEO, drawing on your understanding of AASB 1381AS 38 and the efficient 20187 Justify your answer with reference to relevant paragraphs of AASB 138AS 38 financial statements? market hypothesis (refer to chapter 2 of Loftus) nclude a recommendation as to how the company might mitigate their concerns about investors interpretation of the information reported in the financial statements Task Details: (R&D) project in July 2017 to modify the method of recharging batteries used in its products. The project was successfully completed in June 2018 and the company applied for a patent for the design Technology Enterprises Ltd, a listed company, commenced a research and development Technology Enterprises Ltd plans to modify all products in its consumer range over the next two years and has incorporated these plans into its financial budget. The entity expects to derive economic benefits from the new battery recharging technology over the next 10 years. The accountant was unsure how to account for the project so they used the New Project R&D account to accumulate the salaries of all engineers involved in the project during the year ended 30 June 2018 The following analysis of the salaries expenditure is based on the engineers' time sheets Cost of time spent searching for and evaluating aermative materias Cost of time designing models, and constructing and testing prototypes Cost of time spent on training maintenance workers for the new desig 700000 200000 The value in use of the design, fair value of estimated using present value techniques, is $4 000 000. However, the would need o modity the design to adapt it to its own products The following conversation took place between the chief executive officer (CEO) and the accountant (ACC) CEO That worth $4 000 000 in the balance sheet and add an extra $3 000 000 to profit because it cost only $1 000 000 R&D assef should make our financial statements look great this year. We can show its ACC haven't firalsed accounting tor to measure it at historical cost and some of it wil probably have to be recognised as an but ' am quite sure the accountrg standard reo." u expense CEO It isn't fair. These conservative accounting rules make it impossble to show investors that our project was successful-and expensing any of it will cause our share price to go down because the investors will think it didnt work Required 1. How should the project be accounted for in the financial stabements for the year ended 30 June 2 To what extent might the ruies or restrictions in AASB 138AS 38 reduce the comparablity of 3 Write a response to the CEO, drawing on your understanding of AASB 1381AS 38 and the efficient 20187 Justify your answer with reference to relevant paragraphs of AASB 138AS 38 financial statements? market hypothesis (refer to chapter 2 of Loftus) nclude a recommendation as to how the company might mitigate their concerns about investors interpretation of the information reported in the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts