Question: Task: Final Assignment You are asked to answer all the questions in the proposed two cases. This task assesses the following learning outcomes: Critically understand

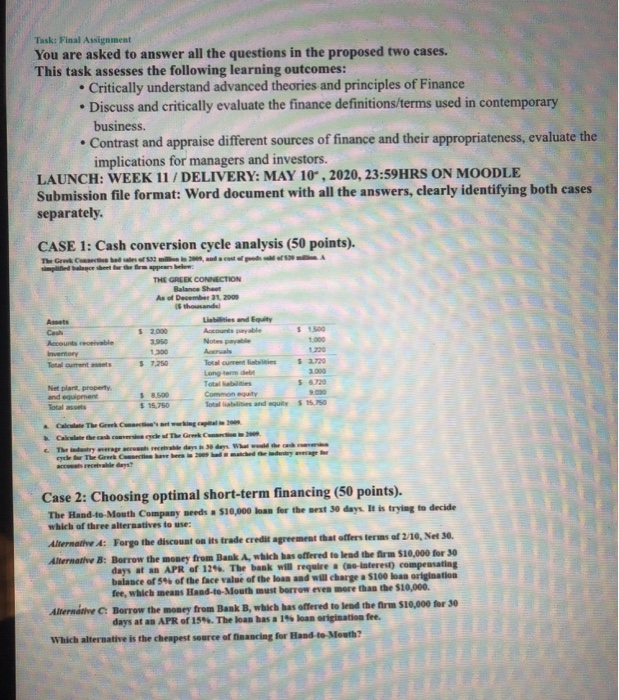

Task: Final Assignment You are asked to answer all the questions in the proposed two cases. This task assesses the following learning outcomes: Critically understand advanced theories and principles of Finance Discuss and critically evaluate the finance definitions/terms used in contemporary business. Contrast and appraise different sources of finance and their appropriateness, evaluate the implications for managers and investors. LAUNCH: WEEK 11 / DELIVERY: MAY 10, 2020, 23:59HRS ON MOODLE Submission file format: Word document with all the answers, clearly identifying both cases separately. CASE 1: Cash conversion cycle analysis (50 points). pedagoe sheet for the fire appeare The Grenada THE GREEK CONNECTION Balance Sheet As of December 2009 I thousands Liais Equity Accountable Notepa Accruals Total Long term Total Common equity $15.750 Totallis and equity The Greek Ce Calehed The dr de The Greek C days w eg 2008 The Greek e dys daw h ewbee 2009 had a Case 2: Choosing optimal short-term financing (50 points). The Hand-to-Mouth Company needs a $10,000 loan for the next 30 days. It is trying to decide which of three alternatives to use: Alternate : Forgo the discount on its trade credit agreement that offers terms of 2/10, Net 30. Alternati : Borrow the money from Bank A, which has offered to lead the firm $10,000 for 30 days at an APR of 124. The bank will require a (no-interest) compensating balance of 5% of the face value of the loss and will charge a $100 loan origination fee, which means Hand-to-Mouth must borrow even more than the $10,000 the Borrow the money from Bank B, which has offered to lead the firm $10,000 for 30 days at an APR of 154.. The loan has a 19 loan origination fee. alternative is the cheapest source of financing for Hand-to-Mouth? Task: Final Assignment You are asked to answer all the questions in the proposed two cases. This task assesses the following learning outcomes: Critically understand advanced theories and principles of Finance Discuss and critically evaluate the finance definitions/terms used in contemporary business. Contrast and appraise different sources of finance and their appropriateness, evaluate the implications for managers and investors. LAUNCH: WEEK 11 / DELIVERY: MAY 10, 2020, 23:59HRS ON MOODLE Submission file format: Word document with all the answers, clearly identifying both cases separately. CASE 1: Cash conversion cycle analysis (50 points). pedagoe sheet for the fire appeare The Grenada THE GREEK CONNECTION Balance Sheet As of December 2009 I thousands Liais Equity Accountable Notepa Accruals Total Long term Total Common equity $15.750 Totallis and equity The Greek Ce Calehed The dr de The Greek C days w eg 2008 The Greek e dys daw h ewbee 2009 had a Case 2: Choosing optimal short-term financing (50 points). The Hand-to-Mouth Company needs a $10,000 loan for the next 30 days. It is trying to decide which of three alternatives to use: Alternate : Forgo the discount on its trade credit agreement that offers terms of 2/10, Net 30. Alternati : Borrow the money from Bank A, which has offered to lead the firm $10,000 for 30 days at an APR of 124. The bank will require a (no-interest) compensating balance of 5% of the face value of the loss and will charge a $100 loan origination fee, which means Hand-to-Mouth must borrow even more than the $10,000 the Borrow the money from Bank B, which has offered to lead the firm $10,000 for 30 days at an APR of 154.. The loan has a 19 loan origination fee. alternative is the cheapest source of financing for Hand-to-Mouth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts