Question: Task: Final Assignment You are asked to answer all the questions in the proposed two cases. This task assesses the following learning outcomes: Critically understand

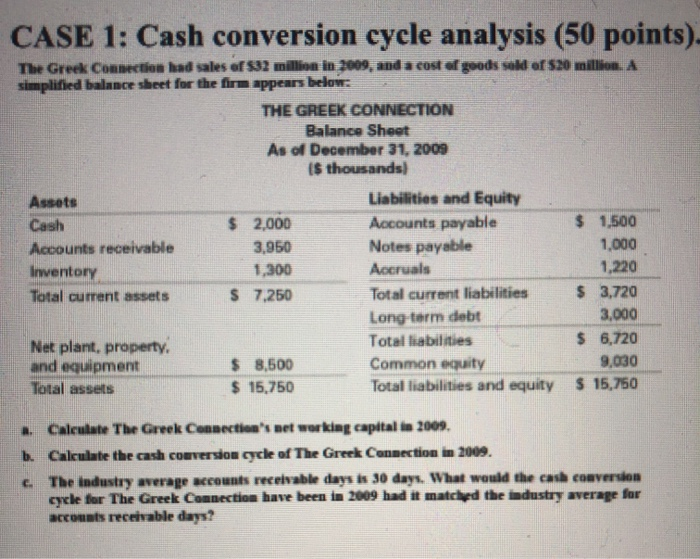

Task: Final Assignment You are asked to answer all the questions in the proposed two cases. This task assesses the following learning outcomes: Critically understand advanced theories and principles of Finance Discuss and critically evaluate the finance definitions/terms used in contemporary business. Contrast and appraise different sources of finance and their appropriateness, evaluate the implications for managers and investors. LAUNCH: WEEK 11 / DELIVERY: MAY 10", 2020, 23:59HRS ON MOODLE Submission file format: Word document with all the answers, clearly identifying both cases separately. CASE 1: Cash conversion cycle analysis (50 points). The Gr e ates and -nair alayalam THE GREEK CONNECTION Balance Sheet As of December 31, 2009 thousands L es and Equity 2000 A counts payable Accounts receivable 3,050 Notes payable Inventory Accra 1.220 Total current ses 57.250 Total current liabilities Long term debit Net plant, property. Totalla s and equipment S 8.500 C ommon guy Totally S Cene The Gre a t working capital Celewater cancer of the Greek Cesset The dustry wa s recadays is 30 days. What would the case converse for The Greek C haber 2009 had het were recebe day? Case 2: Choosing optimal short-term financing (50 points). The Hand-to-Mouth Company needs a $10,000 loan for the next 30 days. It is trying to decide which of three alternatives to use: Alternative A: Forge the discount on its trade credit agreement that offers terms of 2/10, Net 30. Alternative B: Borrow the money from Bank A, which has offered to lead the firm $10,000 for 30 days at an APR of 1296. The bank will require a (no interest) compensating balance of 5 of the face value of the loan and will charge a $100 loss origination fee, which means Hand-to-Mouth must borrow even more than the $10,000. That Borrow the money from Bank B, which has offered to lend the firm $10,000 for 30 days at an APR of 154. The loan has a 1% loan origination fee. ternative is the cheapest source of financing for Hand-to-Mouth? CASE 1: Cash conversion cycle analysis (50 points) The Greek Connection had sales of $32 million in 2009, and a cost of goods sold of $20 million simplified balance sheet for the firm appears below: THE GREEK CONNECTION Balance Sheet As of December 31, 2009 is thousands) Assets Liabilities and Equity Cash 2,000 Accounts payable $ 1,500 Accounts receivable 3,950 Notes payable 1.000 Inventory 1,300 Accruals 1,220 Total current assets S 7.250 Total current liabilities $ 3,720 Long-term debt 3,000 Net plant, property. Total liabilities $ 6,720 and equipment $ 8,500 Common equity 9.030 Total assets $ 15,750 Total liabilities and equity $ 15,750 . Calculate The Greek Connection's net working capital in 2009. Calculate the cash conversion cycle of The Greek Connection in 2009 c. The Industry average accounts receivable dans is 30 days. What would the cash conversion cycle for The Greek Connection have been in 2009 had it matched the industry average for accounts receivable days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts