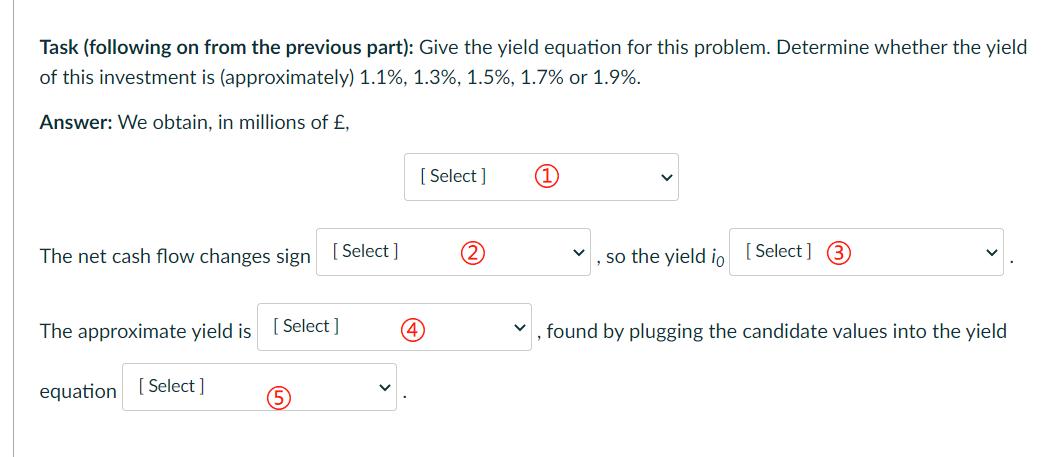

Question: Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%,

![The net cash flow changes sign [Select] The approximate yield is [Select]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/12/61af36ac27747_q23.png)

![equation [Select] 5 [Select] (4) (2) V (1 , so the yield](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/12/61af36c14f046_q24.png)

![io [Select] 3 found by plugging the candidate values into the yield](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/12/61af36d82a33a_q25.png)

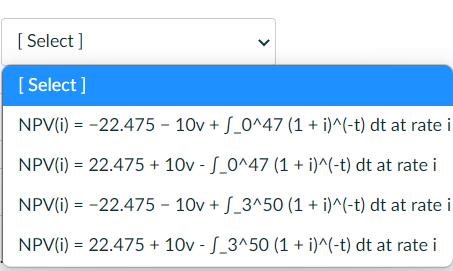

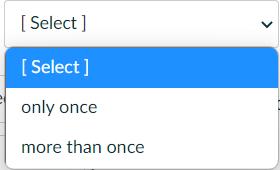

Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , The net cash flow changes sign [Select] The approximate yield is [Select] equation [Select] 5 [Select] (4) (2) V (1 , so the yield io [Select] 3 found by plugging the candidate values into the yield [Select] [Select] NPV(i) = -22.475 - 10v + J_0^47 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v-J_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475-10v+_3^50 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v-J_3^50 (1 + i)^(-t) dt at rate i [Select] [Select] only once more than once [Select] [Select] exists does not exist [Select] [Select] 1.1% 1.3% 1.5% 1.7% 1.9% [Select] [Select] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Task Give the yield equation for this problem Determine whether the yield of thi... View full answer

Get step-by-step solutions from verified subject matter experts