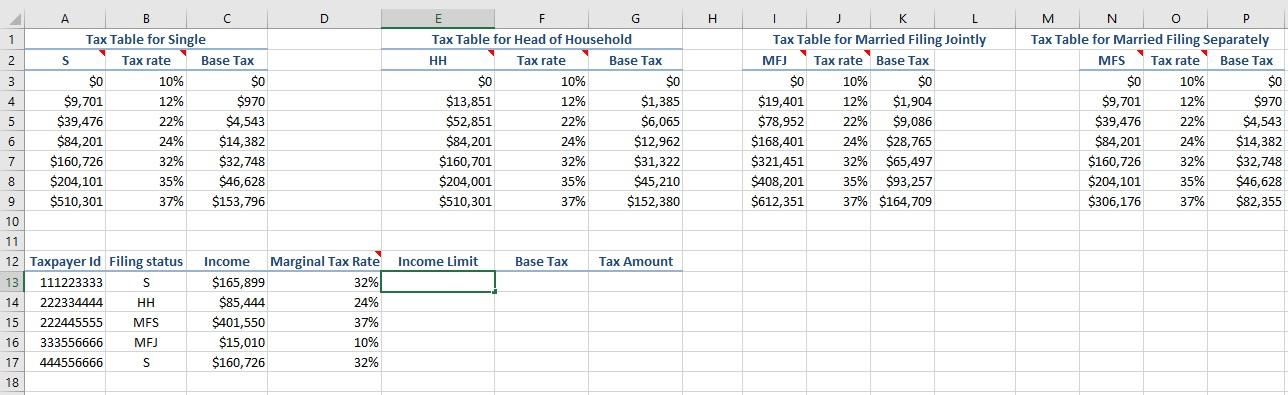

Question: Tax Calculation Worksheet l ) In cell E 1 3 , retrieve the income limit from the appropriate tax table. Use a nested IF function

Tax Calculation Worksheet

l In cell E retrieve the income limit from the appropriate tax table. Use a nested IF function with Vlookup

inside the IF functions to retrieve the first column from the appropriate tax rate table. The formula is

identical to the formula inside the Marginal Tax Rate cell D except for retrieving the first column.

Extend the formula to cells E:E Format the cells as Currency with zero decimal digits. Hint:

Copy the formula from D and paste it into E Update the column index number for each VLookup.

m In cell F retrieve the base tax from the appropriate tax table. Use a nested IF function with Vlookup

inside the IF functions to retrieve the third column from the appropriate tax rate table. The formula is

identical to the formula inside the Marginal Tax Rate cells except for retrieving the third column. Extend

the formula to cells F:F Format the cells as Currency with zero decimal digits.

n In cell G compute the tax amount as the base tax amount plus the marginal tax rate multiplied by the

marginal income income higher than income limit The marginal income is the income minus the income

limit Extend the formula to cells G:G Format the cells as Currency with zero decimal digits.

o Save your workbook and upload it in Canvas.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock