Question: Define the contracting state in which the taxing right prevails and the Indonesian tax obligation (if any) for the followings (assume that 1 US$=

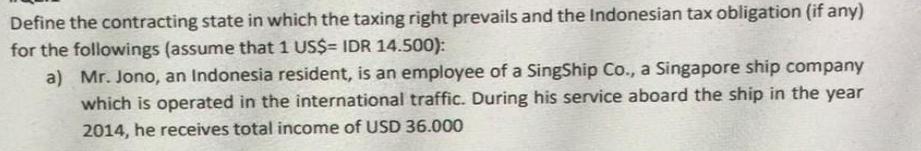

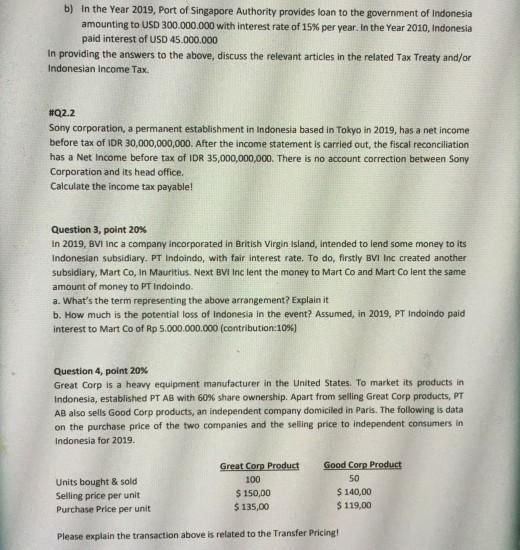

Define the contracting state in which the taxing right prevails and the Indonesian tax obligation (if any) for the followings (assume that 1 US$= IDR 14.500): a) Mr. Jono, an Indonesia resident, is an employee of a SingShip Co., a Singapore ship company which is operated in the international traffic. During his service aboard the ship in the year 2014, he receives total income of USD 36.000 b) In the Year 2019, Port of Singapore Authority provides loan to the government of Indonesia amounting to USD 300.000.000 with interest rate of 15% per year. In the Year 2010, Indonesia paid interest of USD 45.000.000 In providing the answers to the above, discuss the relevant articles in the related Tax Treaty and/or Indonesian Income Tax. #Q2.2 Sony corporation, a permanent establishment in Indonesia based in Tokyo in 2019, has a net income before tax of IDR 30,000,000,000. After the income statement is carried out, the fiscal reconciliation has a Net Income before tax of IDR 35,000,000,000. There is no account correction between Sony Corporation and its head office. Calculate the income tax payable! Question 3, point 20% In 2019, BVI inc a company incorporated in British Virgin Island, intended to lend some money to its Indonesian subsidiary. PT Indoindo, with fair interest rate. To do, firstly BVI Inc created another subsidiary, Mart Co, In Mauritius. Next BVI Inc lent the money to Mart Co and Mart Co lent the same amount of money to PT Indoindo. a. What's the term representing the above arrangement? Explain it b. How much is the potential loss of Indonesia in the event? Assumed, in 2019, PT Indoindo paid interest to Mart Co of Rp 5.000.000.000 (contribution:109%) Question 4, point 20% Great Corp is a heavy equipment manufacturer in the United States. To market its products in Indonesia, established PT AB with 60% share ownership. Apart from selling Great Corp products, PT AB also sells Good Corp products, an independent company domiciled in Paris. The following is data on the purchase price of the two companies and the selling price to independent consumers in Indonesia for 2019. Great Corp Product Good Corp Product Units bought & sold 100 50 $ 150,00 $ 135,00 $ 140,00 $ 119,00 Selling price per unit Purchase Price per unit Please explain the transaction above is related to the Transfer Pricing!

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Part 1 Part 2 Part 3 Part 4 Discussing the Relerand auricle in the Related Tux ... View full answer

Get step-by-step solutions from verified subject matter experts