Question: tements. 110 Chapters 10 & 11 Homework Handout e statement. 5 The employer records the amount of federal income tax withheld from employees I moldon't

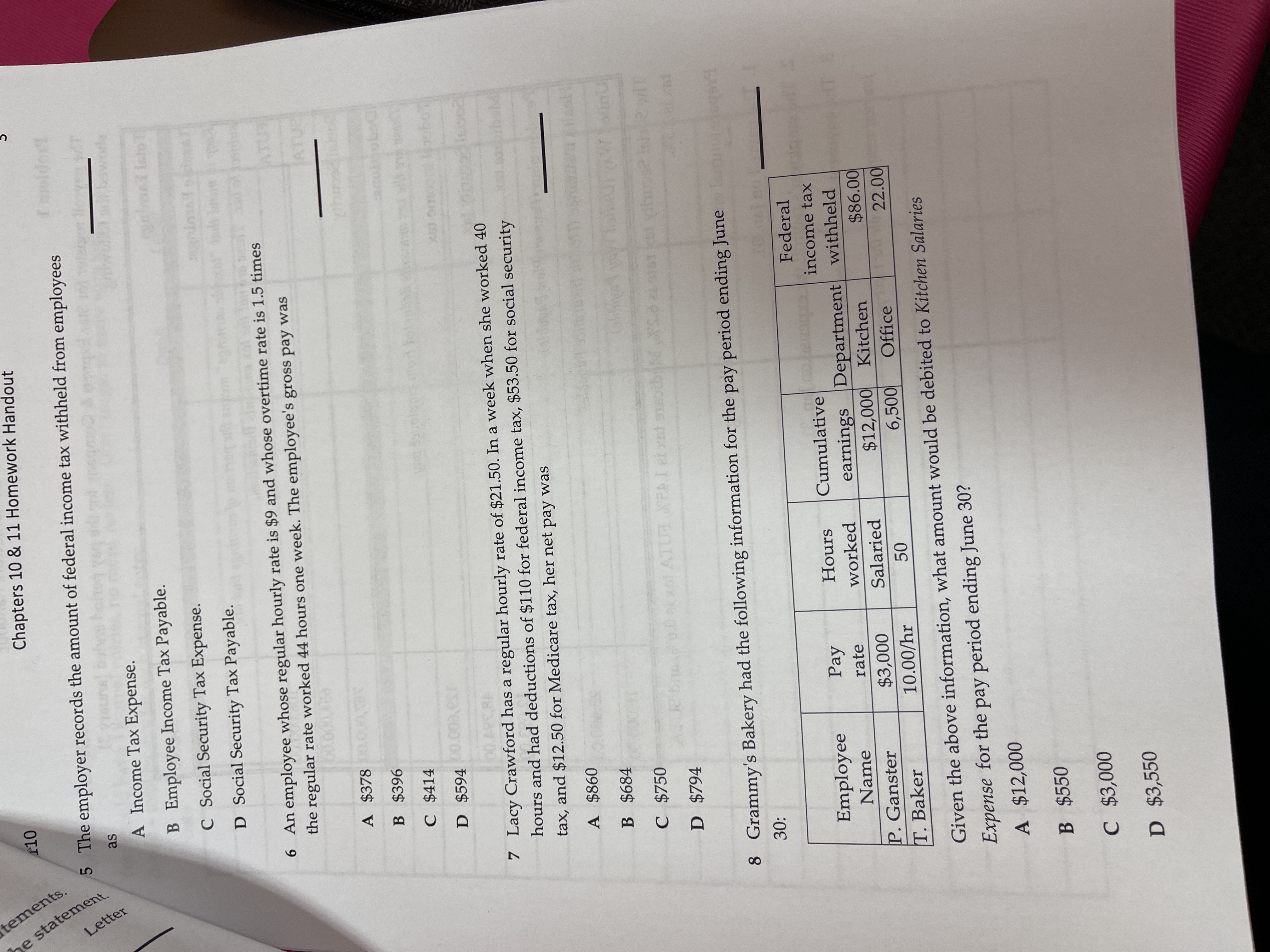

tements. 110 Chapters 10 & 11 Homework Handout e statement. 5 The employer records the amount of federal income tax withheld from employees I moldon't Letter as A Income Tax Expense. B Employee Income Tax Payable. C Social Security Tax Expense. :animal s.dexsT D Social Security Tax Payable. An employee whose regular hourly rate is $9 and whose overtime rate is 1.5 times ATUZ the regular rate worked 44 hours one week. The employee's gross pay was ATU A $378 B $396 C $414 D $594 100.00.es Lacy Crawford has a regular hourly rate of $21.50. In a week when she worked 40 hours and had deductions of $110 for federal income tax, $53.50 for social security bibsM tax, and $12.50 for Medicare tax, her net pay was A $860 B $684 C $750 Are bris choose ish Part D $794 8 Grammy's Bakery had the following information for the pay period ending June 30: Federal Employee Pay Hours Cumulative income tax Name rate worked earnings Department withheld P. Ganster $3,000 Salaried $12,000 Kitchen $86.00 T. Baker 10.00/hr 50 6,500 Office 22.00 Given the above information, what amount would be debited to Kitchen Salaries Expense for the pay period ending June 30? A $12,000 B $550 C $3,000 D $3,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts