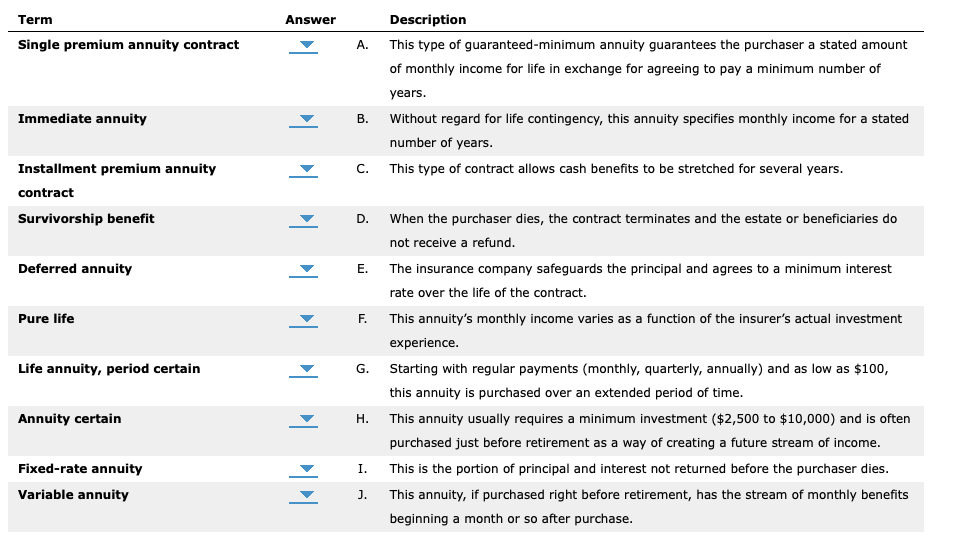

Question: Term Answer Description Single premium annuity contract A. This type of guaranteed-minimum annuity guarantees the purchaser a stated amount of monthly income for life in

Term Answer Description Single premium annuity contract A. This type of guaranteed-minimum annuity guarantees the purchaser a stated amount of monthly income for life in exchange for agreeing to pay a minimum number of years. Without regard for life contingency, this annuity specifies monthly income for a stated number of years. This type of contract allows cash benefits to be stretched for several years. Immediate annuity la B. la C. Installment premium annuity contract Survivorship benefit la Deferred annuity la Pure life la F. Life annuity, period certain la When the purchaser dies, the contract terminates and the estate or beneficiaries do not receive a refund. The insurance company safeguards the principal and agrees to a minimum interest rate over the life of the contract. This annuity's monthly income varies as a function of the insurer's actual investment experience. Starting with regular payments (monthly, quarterly, annually) and as low as $100, this annuity is purchased over an extended period of time. This annuity usually requires a minimum investment ($2,500 to $10,000) and is often purchased just before retirement as a way of creating a future stream of income. This is the portion of principal and interest not returned before the purchaser dies. This annuity, if purchased right before retirement, has the stream of monthly benefits beginning a month or so after purchase. Annuity certain la H. Fixed-rate annuity Variable annuity la la I. J. Term Answer Description Single premium annuity contract A. This type of guaranteed-minimum annuity guarantees the purchaser a stated amount of monthly income for life in exchange for agreeing to pay a minimum number of years. Without regard for life contingency, this annuity specifies monthly income for a stated number of years. This type of contract allows cash benefits to be stretched for several years. Immediate annuity la B. la C. Installment premium annuity contract Survivorship benefit la Deferred annuity la Pure life la F. Life annuity, period certain la When the purchaser dies, the contract terminates and the estate or beneficiaries do not receive a refund. The insurance company safeguards the principal and agrees to a minimum interest rate over the life of the contract. This annuity's monthly income varies as a function of the insurer's actual investment experience. Starting with regular payments (monthly, quarterly, annually) and as low as $100, this annuity is purchased over an extended period of time. This annuity usually requires a minimum investment ($2,500 to $10,000) and is often purchased just before retirement as a way of creating a future stream of income. This is the portion of principal and interest not returned before the purchaser dies. This annuity, if purchased right before retirement, has the stream of monthly benefits beginning a month or so after purchase. Annuity certain la H. Fixed-rate annuity Variable annuity la la I. J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts