Question: These are not necessarily complete definitions, but there is only one possible answer for each term. Single premium annuity contract A. This is the portion

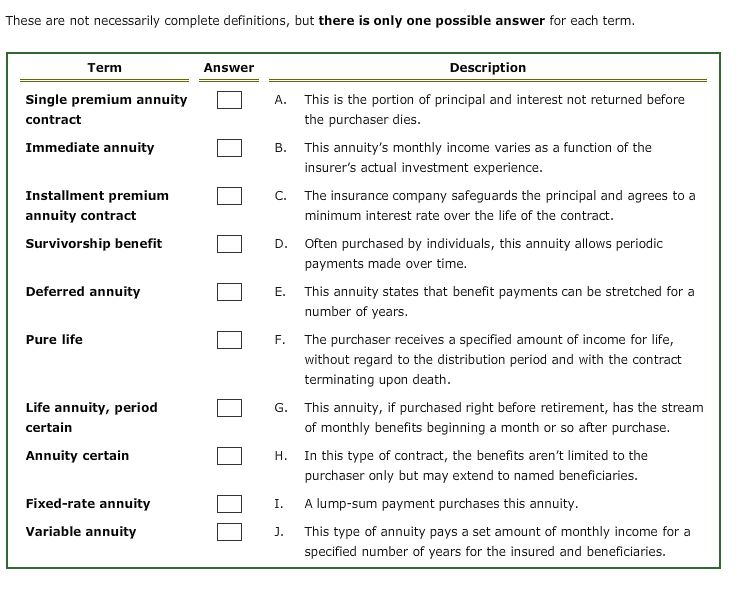

These are not necessarily complete definitions, but there is only one possible answer for each term. Single premium annuity contract A. This is the portion of principal and interest not returned before the purchaser dies. Immediate annuity B. This annuity's monthly income varies as a function of the insurer's actual investment experience. Installment premium annuity contract C. The insurance company safeguards the principal and agrees to a minimum interest rate over the life of the contract. Survivorship benefit D. Often purchased by individuals, this annuity allows periodic payments made over time. Deferred annuity E. This annuity states that benefit payments can be stretched for a number of years. Pure life F. The purchaser receives a specified amount of income for life, without regard to the distribution period and with the contract terminating upon death. Life annuity, period certain G. This annuity, if purchased right before retirement, has the stream of monthly benefits beginning a month or so after purchase. Annuity certain H. In this type of contract, the benefits aren't limited to the purchaser only but may extend to named beneficiaries. Fixed-rate annuity I. A lump-sum payment purchases this annuity. Variable annuity J. This type of annuity pays a set amount of monthly income for a specified number of years for the insured and beneficiaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts