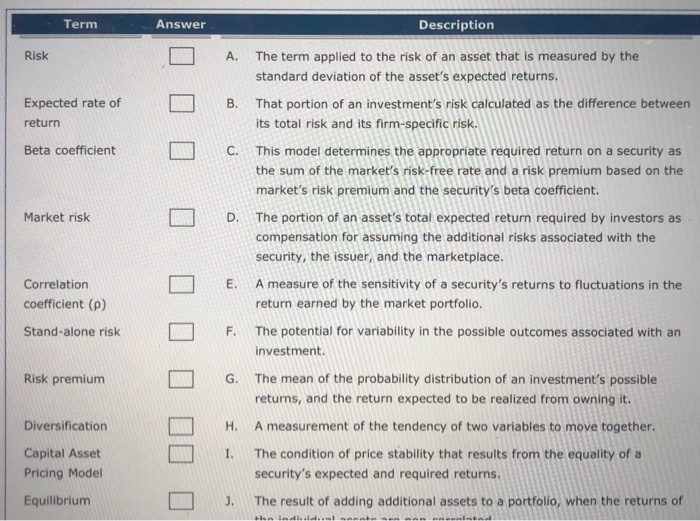

Question: Term Description Risk A. The term applied to the risk of an asset that is measured by the standard deviation of the asset's expected returns.

Term Description Risk A. The term applied to the risk of an asset that is measured by the standard deviation of the asset's expected returns. That portion of an investment's risk calculated as the difference between its total risk and its firm-specific risk. Expected rate of return B. Beta coefficient L C . This model determines the appropriate required return on a security as the sum of the market's risk-free rate and a risk premium based on the market's risk premium and the security's beta coefficient. Market risk D. 1000 0 00000 0 The portion of an asset's total expected return required by investors as compensation for assuming the additional risks associated with the security, the issuer, and the marketplace. Correlation coefficient (P) A measure of the sensitivity of a security's returns to fluctuations in the return earned by the market portfolio. Stand-alone risk F. The potential for variability in the possible outcomes associated with an investment. Risk premium Diversification G. The mean of the probability distribution of an investment's possible returns, and the return expected to be realized from owning it. H. A measurement of the tendency of two variables to move together. I. The condition of price stability that results from the equality of a security's expected and required returns. J. The result of adding additional assets to a portfolio, when the returns of Capital Asset Pricing Model Equilibrium the ladiel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts