Question: Terry White is creating an asset allocation for an institutional portfolio with a plan to fund the entire operation of the institute from the returns

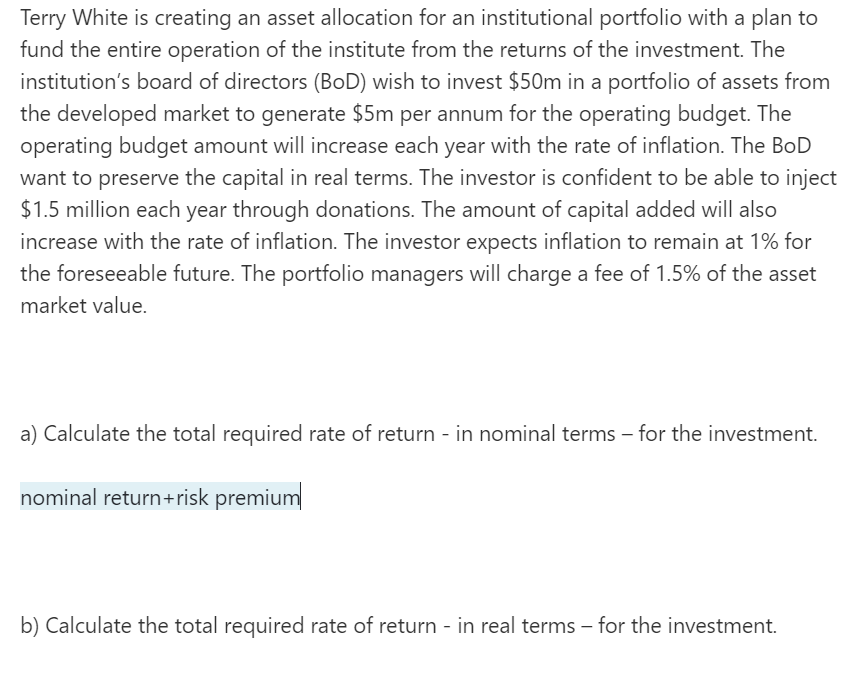

Terry White is creating an asset allocation for an institutional portfolio with a plan to fund the entire operation of the institute from the returns of the investment. The institution's board of directors (BoD) wish to invest $50m in a portfolio of assets from the developed market to generate $5m per annum for the operating budget. The operating budget amount will increase each year with the rate of inflation. The BoD want to preserve the capital in real terms. The investor is confident to be able to inject $1.5 million each year through donations. The amount of capital added will also increase with the rate of inflation. The investor expects inflation to remain at 1% for the foreseeable future. The portfolio managers will charge a fee of 1.5% of the asset market value. a) Calculate the total required rate of return - in nominal terms - for the investment. nominal return+risk premium b) Calculate the total required rate of return - in real terms - for the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts