Question: * Test Information Description Instructions This is Section A of Tutorial Assignment 3 It comprises 15 multi-choice questions. Please select the BEST answer to each

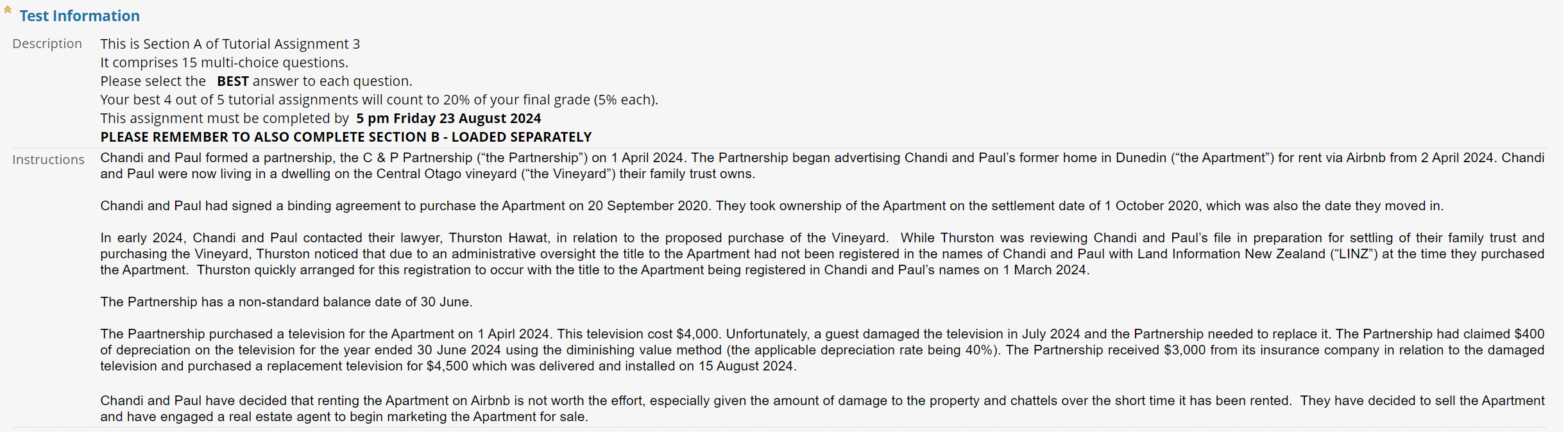

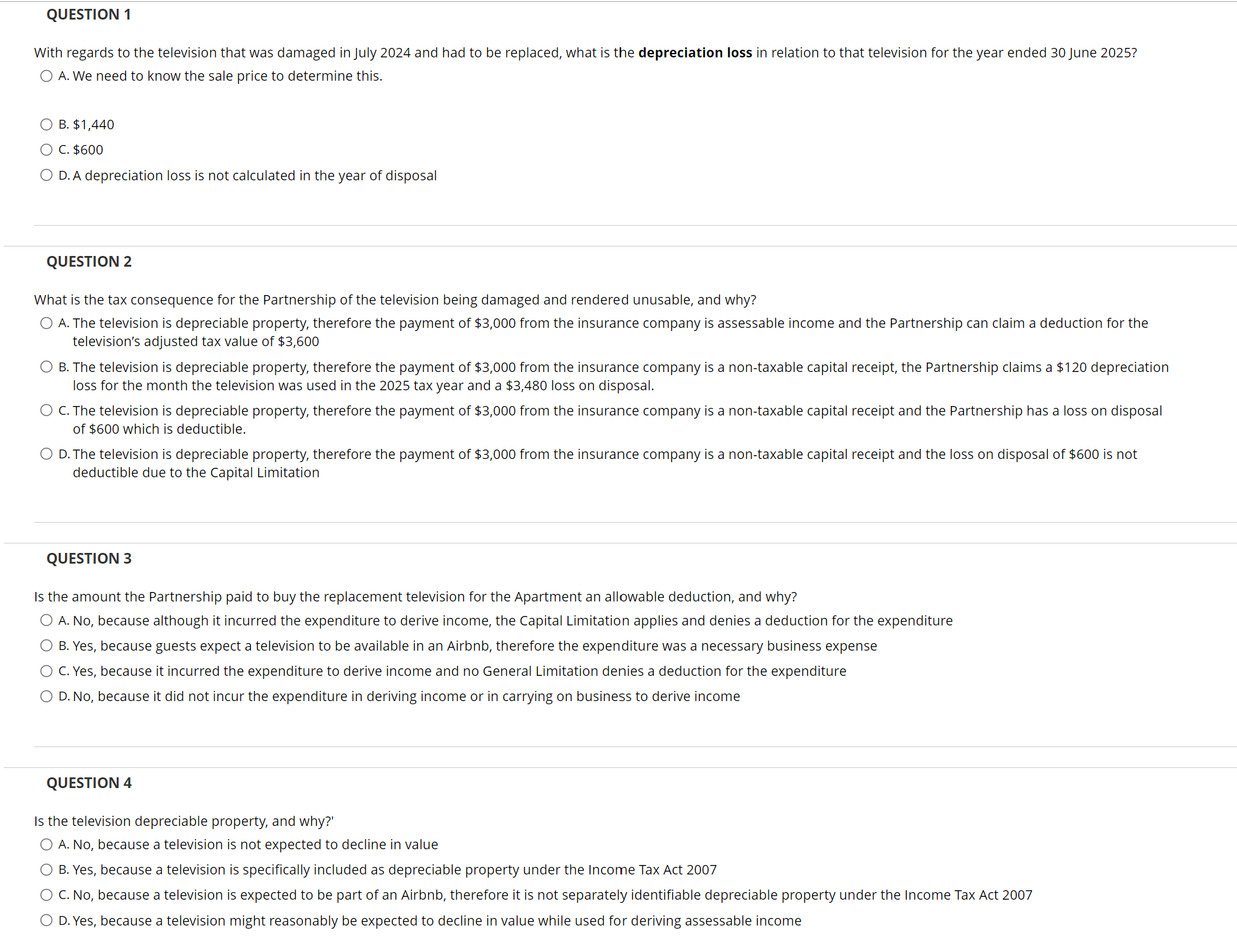

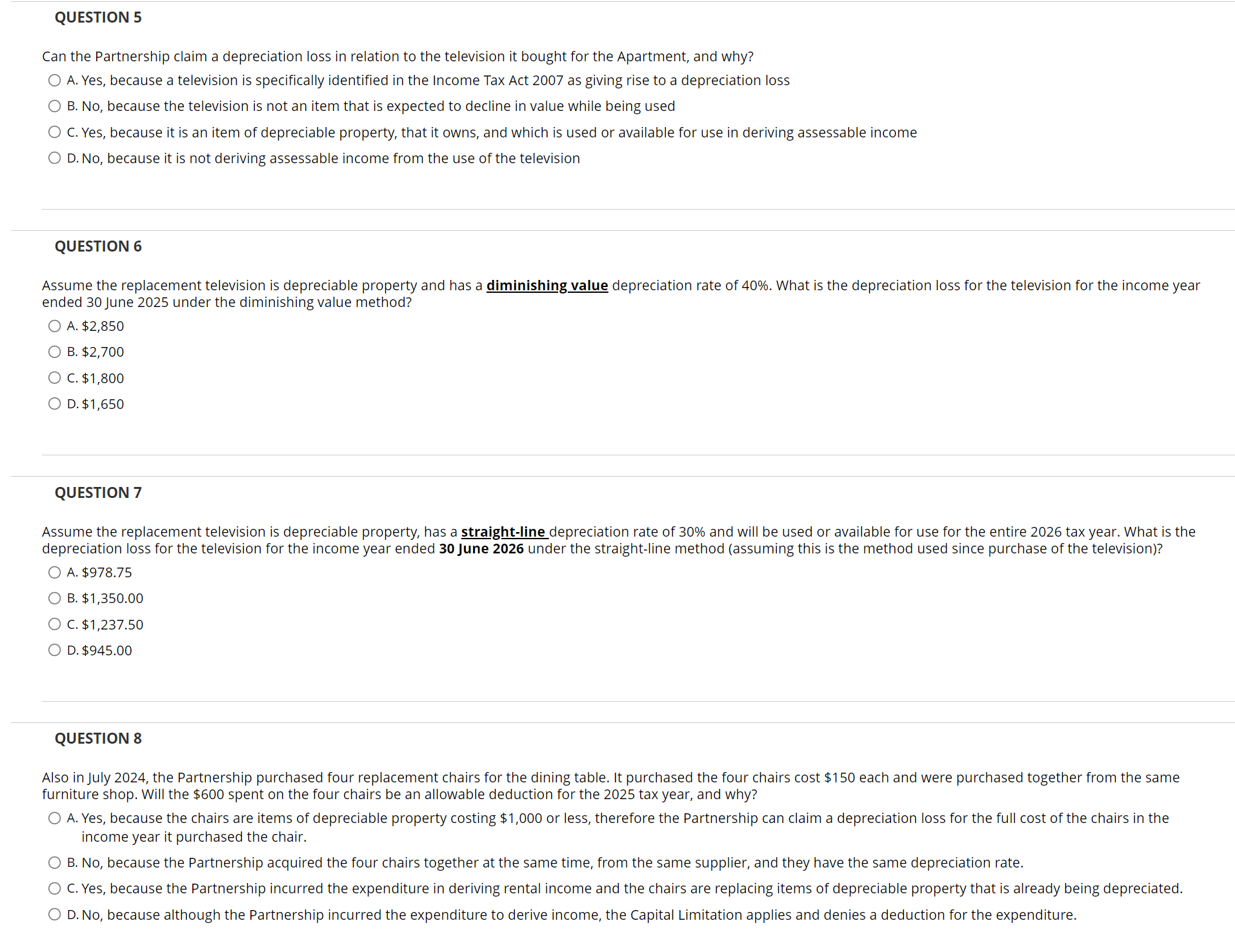

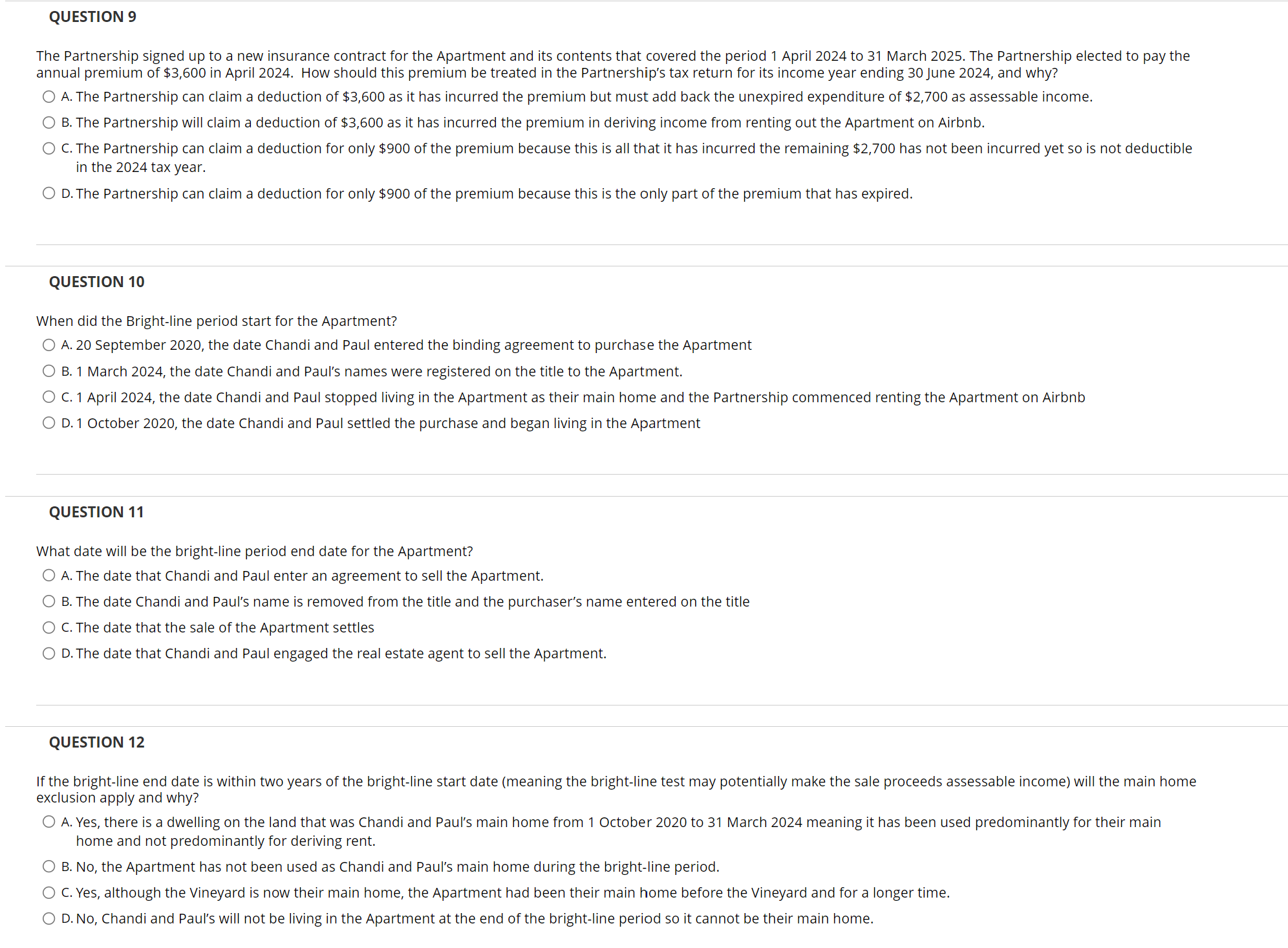

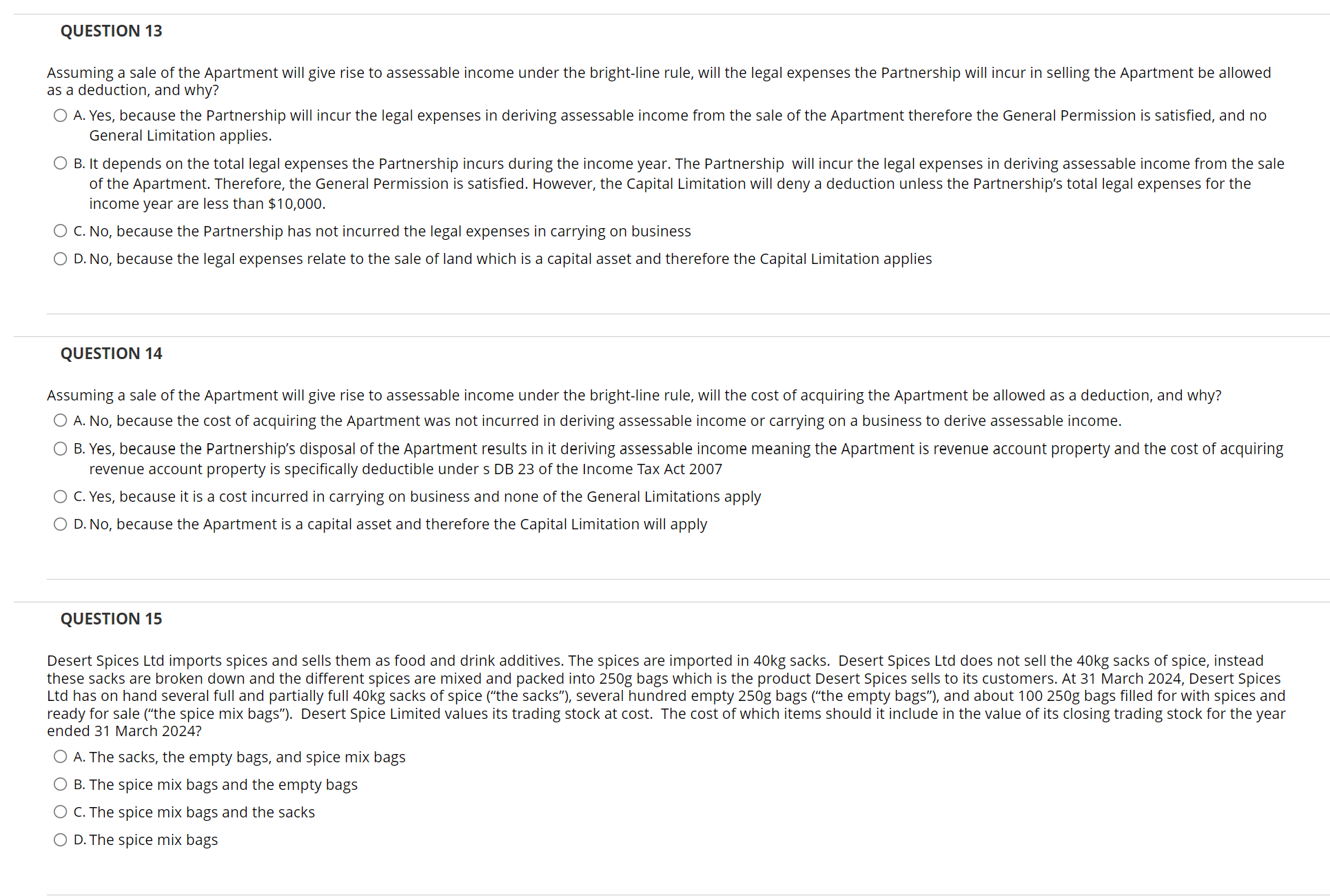

* Test Information Description Instructions This is Section A of Tutorial Assignment 3 It comprises 15 multi-choice questions. Please select the BEST answer to each question. Your best 4 out of 5 tutorial assignments will count to 20% of your final grade (5% each). This assignment must be completed by 5 pm Friday 23 August 2024 PLEASE REMEMBER TO ALSO COMPLETE SECTION B - LOADED SEPARATELY Chandi and Paul formed a partnership, the C & P Partnership (\"the Partnership\") on 1 April 2024. The Partnership began advertising Chandi and Paul's former home in Dunedin (\"the Apartment\") for rent via Airbnb from 2 April 2024. Chandi and Paul were now living in a dwelling on the Central Otago vineyard (\"the Vineyard\") their family trust owns. Chandi and Paul had signed a binding agreement to purchase the Apartment on 20 September 2020. They took ownership of the Apartment on the settlement date of 1 October 2020, which was also the date they moved in. In early 2024, Chandi and Paul contacted their lawyer, Thurston Hawat, in relation to the proposed purchase of the Vineyard. While Thurston was reviewing Chandi and Paul's file in preparation for settling of their family trust and purchasing the Vineyard, Thurston noticed that due to an administrative oversight the title to the Apartment had not been registered in the names of Chandi and Paul with Land Information New Zealand (\"LINZ") at the time they purchased the Apartment. Thurston quickly arranged for this registration to occur with the title to the Apartment being registered in Chandi and Paul''s names on 1 March 2024. The Partnership has a non-standard balance date of 30 June. The Paartnership purchased a television for the Apartment on 1 Apirl 2024. This television cost $4,000. Unfortunately, a guest damaged the television in July 2024 and the Partnership needed to replace it. The Partnership had claimed $400 of depreciation on the television for the year ended 30 June 2024 using the diminishing value method (the applicable depreciation rate being 40%). The Partnership received $3,000 from its insurance company in relation to the damaged television and purchased a replacement television for $4,500 which was delivered and installed on 15 August 2024. Chandi and Paul have decided that renting the Apartment on Airbnb is not worth the effort, especially given the amount of damage to the property and chattels over the short time it has been rented. They have decided to sell the Apartment and have engaged a real estate agent to begin marketing the Apartment for sale. QUESTION 1 With regards to the television that was damaged in July 2024 and had to be replaced, what is the depreciation less in relation to that television for the year ended 30 June 2025? (O A.We need to know the sale price to determine this. O B.$1,440 O C.$600 O D.Adepreciation loss is not calculated in the year of disposal QUESTION 2 What is the tax consequence for the Partnership of the television being damaged and rendered unusable, and why? O A.The television is depreciable property, therefore the payment of $3,000 from the insurance company is assessable income and the Partnership can claim a deduction for the television's adjusted tax value of $3,600 O B. The television is depreciable property, therefore the payment of $3,000 from the insurance company is a non-taxable capital receipt, the Partnership claims a $120 depreciation loss for the month the television was used in the 2025 tax year and a $3,480 loss on disposal. O C.The television is depreciable property, therefore the payment of $3,000 from the insurance company is a non-taxable capital receipt and the Partnership has a loss on disposal of $600 which is deductible. O D.The television is depreciable property, therefore the payment of $3,000 from the insurance company is a non-taxable capital receipt and the loss on disposal of $600 is not deductible due to the Capital Limitation QUESTION 3 Is the amount the Partnership paid to buy the replacement television for the Apartment an allowable deduction, and why? O A.No, because although it incurred the expenditure to derive income, the Capital Limitation applies and denies a deduction for the expenditure O B. Yes, because guests expect a television to be available in an Airbnb, therefore the expenditure was a necessary business expense (O C.Yes, because it incurred the expenditure to derive income and no General Limitation denies a deduction for the expenditure O D.No, because it did not incur the expenditure in deriving income or in carrying on business to derive income QUESTION 4 Is the television depreciable property, and why?' O A.No, because a television is not expected to decline in value O B.Yes, because a television is specifically included as depreciable property under the Income Tax Act 2007 (O C.No, because a television is expected to be part of an Airbnb, therefore it is not separately identifiable depreciable property under the Income Tax Act 2007 O D.Yes, because a television might reasonably be expected to decline in value while used for deriving assessable income QUESTION 5 Can the Partnership claim a depreciation loss in relation to the television it bought for the Apartment, and why? O A.Yes, because a television is specifically identified in the Income Tax Act 2007 as giving rise to a depreciation loss O B. No, because the television is not an item that is expected to decline in value while being used O C.Yes, because it is an item of depreciable property, that it owns, and which is used or available for use in deriving assessable income O D.No, because it is not deriving assessable income from the use of the television QUESTION 6 Assume the replacement television is depreciable property and has a diminishing value depreciation rate of 40%. What is the depreciation loss for the television for the income year ended 30 June 2025 under the diminishing value method? O A $2,850 O B.$2,700 O C.$1,800 O D.$1,650 QUESTION 7 Assume the replacement television is depreciable property, has a straight-line depreciation rate of 30% and will be used or available for use for the entire 2026 tax year. What is the depreciation loss for the television for the income year ended 30 June 2026 under the straight-line method (assuming this is the method used since purchase of the television)? O A.$978.75 O B.$1,350.00 O C.$1,237.50 O D.$945.00 QUESTION 8 Also in July 2024, the Partnership purchased four replacement chairs for the dining table. It purchased the four chairs cost $150 each and were purchased together from the same furniture shop. Will the $600 spent on the four chairs be an allowable deduction for the 2025 tax year, and why? O A.Yes, because the chairs are items of depreciable property costing $1,000 or less, therefore the Partnership can claim a depreciation loss for the full cost of the chairs in the income year it purchased the chair. O B.No, because the Partnership acquired the four chairs together at the same time, from the same supplier, and they have the same depreciation rate. O C.Yes, because the Partnership incurred the expenditure in deriving rental income and the chairs are replacing items of depreciable property that is already being depreciated. O D.No, because although the Partnership incurred the expenditure to derive income, the Capital Limitation applies and denies a deduction for the expenditure. QUESTION 9 The Partnership signed up to a new insurance contract for the Apartment and its contents that covered the period 1 April 2024 to 31 March 2025. The Partnership elected to pay the annual premium of $3,600 in April 2024, How should this premium be treated in the Partnership's tax return for its income year ending 30 June 2024, and why? O A.The Partnership can claim a deduction of $3,600 as it has incurred the premium but must add back the unexpired expenditure of $2,700 as assessable income. O B.The Partnership will claim a deduction of $3,600 as it has incurred the premium in deriving income from renting out the Apartment on Airbnb. O C.The Partnership can claim a deduction for only $900 of the premium because this is all that it has incurred the remaining $2,700 has not been incurred yet so is not deductible in the 2024 tax year. O D.The Partnership can claim a deduction for only $900 of the premium because this is the only part of the premium that has expired. QUESTION 10 When did the Bright-line period start for the Apartment? O A.20 September 2020, the date Chandi and Paul entered the binding agreement to purchase the Apartment O B. 1 March 2024, the date Chandi and Paul's names were registered on the title to the Apartment. O C.1 April 2024, the date Chandi and Paul stopped living in the Apartment as their main home and the Partnership commenced renting the Apartment on Airbnb O D. 1 October 2020, the date Chandi and Paul settled the purchase and began living in the Apartment QUESTION 11 What date will be the bright-line period end date for the Apartment? O A.The date that Chandi and Paul enter an agreement to sell the Apartment. O B. The date Chandi and Paul's name is removed from the title and the purchaser's name entered on the title O C.The date that the sale of the Apartment settles O D.The date that Chandi and Paul engaged the real estate agent to sell the Apartment. QUESTION 12 If the bright-line end date is within twa years of the bright-line start date (meaning the bright-line test may potentially make the sale proceeds assessable income) will the main home exclusion apply and why? O A.Yes, there is a dwelling on the land that was Chandi and Paul's main home from 1 October 2020 to 31 March 2024 meaning it has been used predominantly for their main home and not predominantly for deriving rent. O B. No, the Apartment has not been used as Chandi and Paul's main home during the bright-line period. O C.Yes, although the Vineyard is now their main home, the Apartment had been their main home before the Vineyard and for a longer time. O D.No, Chandi and Paul's will not be living in the Apartment at the end of the bright-line period so it cannot be their main home. QUESTION 13 Assuming a sale of the Apartment will give rise to assessable income under the bright-line rule, will the legal expenses the Partnership will incur in selling the Apartment be allowed as a deduction, and why? O A.Yes, because the Partnership will incur the legal expenses in deriving assessable income from the sale of the Apartment therefore the General Permission is satisfied, and no General Limitation applies. O B. It depends on the total legal expenses the Partnership incurs during the income year. The Partnership will incur the legal expenses in deriving assessable income from the sale of the Apartment. Therefore, the General Permission is satisfied. However, the Capital Limitation will deny a deduction unless the Partnership's total legal expenses for the income year are less than $10,000. O C.No, because the Partnership has not incurred the legal expenses in carrying on business O D.No, because the legal expenses relate to the sale of land which is a capital asset and therefore the Capital Limitation applies QUESTION 14 Assuming a sale of the Apartment will give rise to assessable income under the bright-line rule, will the cost of acquiring the Apartment be allowed as a deduction, and why? O A.No, because the cost of acquiring the Apartment was not incurred in deriving assessable income or carrying on a business to derive assessable income. O B. Yes, because the Partnership's disposal of the Apartment results in it deriving assessable income meaning the Apartment is revenue account property and the cost of acquiring revenue account property is specifically deductible under s DB 23 of the Income Tax Act 2007 O C.Yes, because it is a cost incurred in carrying on business and none of the General Limitations apply O D.No, because the Apartment is a capital asset and therefore the Capital Limitation will apply QUESTION 15 Desert Spices Ltd imports spices and sells them as food and drink additives. The spices are imported in 40kg sacks. Desert Spices Ltd does not sell the 40kg sacks of spice, instead these sacks are broken down and the different spices are mixed and packed into 250g bags which is the product Desert Spices sells to its customers. At 31 March 2024, Desert Spices Ltd has on hand several full and partially full 40kg sacks of spice (\"the sacks"), several hundred empty 250g bags (\"the empty bags\"), and about 100 250g bags filled for with spices and ready for sale (\"the spice mix bags\"). Desert Spice Limited values its trading stock at cost. The cost of which items should it include in the value of its closing trading stock for the year ended 31 March 2024? O A.The sacks, the empty bags, and spice mix bags O B. The spice mix bags and the empty bags O C.The spice mix bags and the sacks O D.The spice mix bags

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts