Question: Thank you for the help and the explication, but the answer in the book is 120,000 could it be that the answer in the book

Thank you for the help and the explication, but the answer in the book is 120,000 could it be that the answer in the book is wrong?

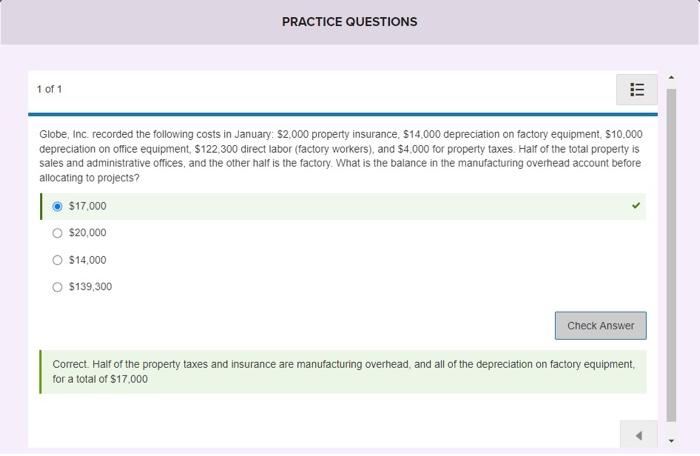

PRACTICE QUESTIONS 1 of 1 Globe, Inc. recorded the following costs in January: $2,000 property insurance, $14,000 depreciation on factory equipment, $10,000 depreciation on office equipment, $122,300 direct labor (factory workers), and $4,000 for property taxes. Half of the total property is sales and administrative offices, and the other half is the factory. What is the balance in the manufacturing overhead account before allocating to projects? $17,000$20,000$14,000$139,300 Correct. Half of the property taxes and insurance are manufacturing overhead, and all of the depreciation on factory equipment, for a total of $17,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts