Question: Thank you... Using the data from the table what is the volatility of an equally weighted portfolio of Alaska Air (ALK), Kellogg (K), and Microsoft

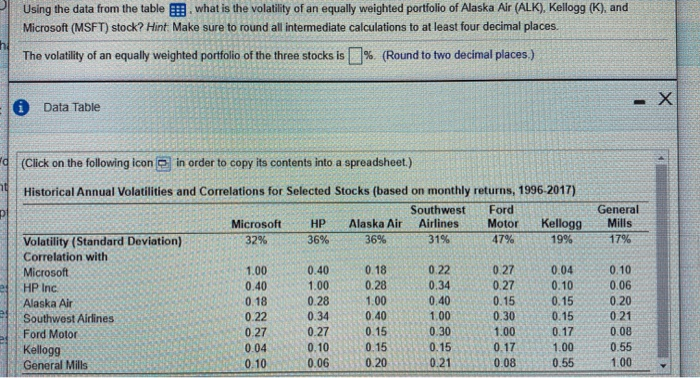

Using the data from the table what is the volatility of an equally weighted portfolio of Alaska Air (ALK), Kellogg (K), and Microsoft (MSFT) stock? Hint Make sure to round all intermediate calculations to at least four decimal places. The volatility of an equally weighted portfolio of the three stocks is %. (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) General Mills 179% Historical Annual Volatilities and Correlations for Selected Stocks (based on monthly returns, 1996 2017) Southwest Ford Microsoft HP Alaska Air Airlines Motor Kellogg Volatility (Standard Deviation) 32% 36% 36% 31% 47% 19% Correlation with Microsoft 1.00 0.40 0.18 0.22 0.27 0.04 HP Inc 0.34 0.10 Alaska Air 0.28 1.00 0.40 0.15 0.15 Southwest Airlines 0.22 0.34 0.40 1.00 0.30 0.15 Ford Motor 0.27 0.27 0.15 0.30 1.00 0.17 Kellogg 0.04 0.10 0.15 0.17 1.00 General Mills 0.10 0.06 0.08 0.55 0.10 0.06 40 1.00 0.28 0.27 0.20 0.21 0.08 0.55 1.00 0.21

Step by Step Solution

There are 3 Steps involved in it

The correct answer to the question is all answer choices Money market securities include Commerc... View full answer

Get step-by-step solutions from verified subject matter experts