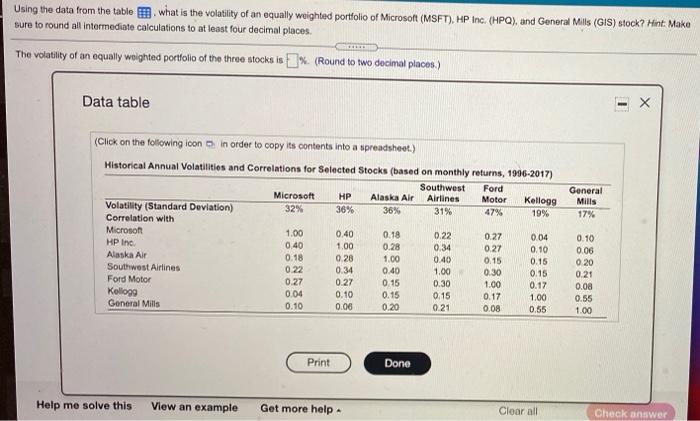

Question: Using the data from the table what is the volatility of an equally weighted portfolio of Microsoft (MSFT), HP Inc. (HPC), and General Mills (GIS)

Using the data from the table what is the volatility of an equally weighted portfolio of Microsoft (MSFT), HP Inc. (HPC), and General Mills (GIS) stock? Hint. Make sure to round all intermediate calculations to at least four decimal places The volatility of an equally wnighted portfolio of the three stocks is 3%. (Round to two decimal places.) Data table x HP General Mills 17% (Click on the following icon in order to copy its contents into a spreadsheet.) Historical Annual Volatilities and Correlations for Selected Stocks (based on monthly returns, 1996-2017) Southwest Ford Microsoft Alaska Air Airlines Motor Volatility (Standard Deviation) Kellogg 32% 36% 36% 31% 47% Correlation with 19% Microson 1.00 0.40 0.18 0.22 0.27 0.04 HP Inc 0.40 1.00 0.28 0.34 027 0.10 Alaska Air 0.18 0.28 0.40 0.15 0.15 Southwest Airlines 0.22 0.34 0.40 1.00 0.30 0.15 Ford Motor 0.27 0.27 0.15 0.30 1.00 0.17 Kellogg 0.04 0.10 0.15 0.15 0.17 1.00 General Mills 0.10 0.06 0.20 0.21 0.08 0.55 1.00 0.10 0.06 020 0.21 0.00 0.55 1.00 Print Done Help me solve this View an example Get more help Cloor all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts