Question: Using the data from the Table , what is the volatility of an equally weighted portfolio of General Motors (GM), Alaska Air (ALK), and General

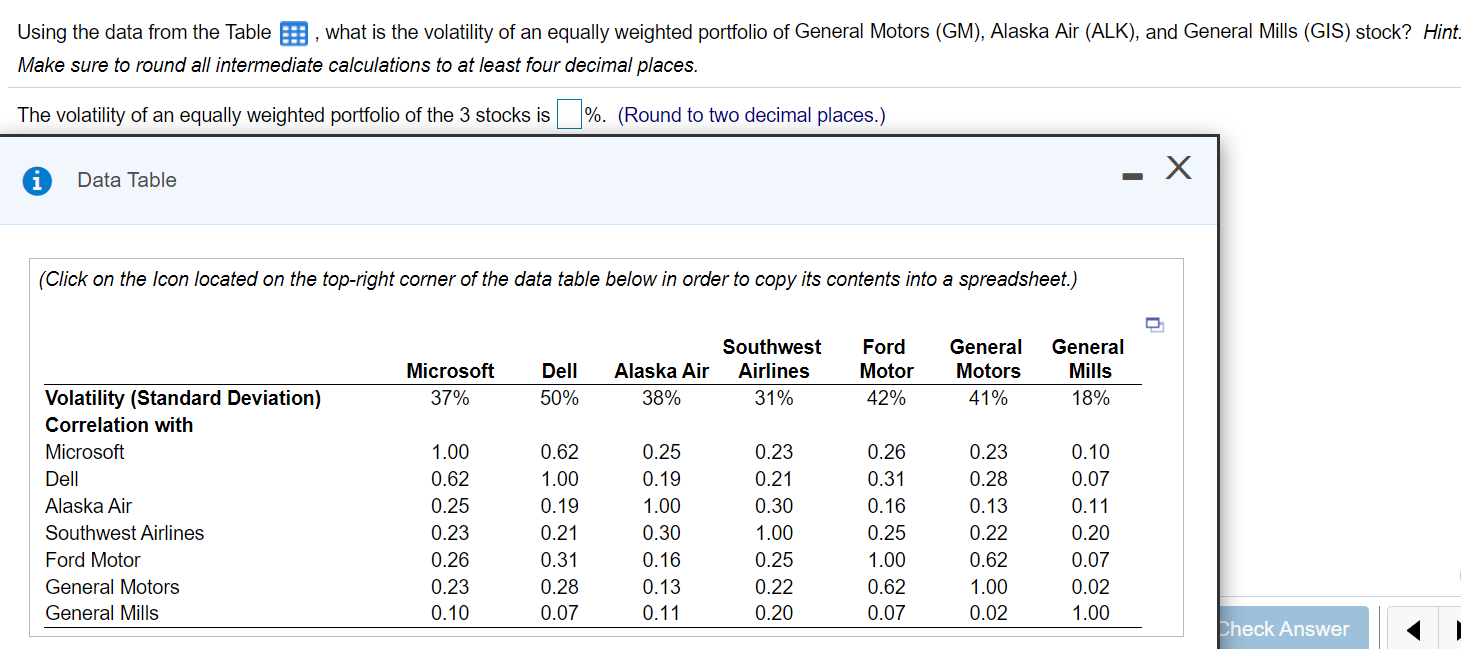

Using the data from the Table , what is the volatility of an equally weighted portfolio of General Motors (GM), Alaska Air (ALK), and General Mills (GIS) stock? Hint. Make sure to round all intermediate calculations to at least four decimal places. The volatility of an equally weighted portfolio of the 3 stocks is %. (Round to two decimal places.) 1 Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Microsoft 37% Dell 50% Alaska Air 38% Southwest Airlines 31% Ford Motor 42% General Motors 41% General Mills 18% Volatility (Standard Deviation) Correlation with Microsoft Dell Alaska Air Southwest Airlines Ford Motor General Motors General Mills 1.00 0.62 0.25 0.23 0.26 0.23 0.10 0.62 1.00 0.19 0.21 0.31 0.28 0.07 0.25 0.19 1.00 0.30 0.16 0.13 0.11 0.23 0.21 0.30 1.00 0.25 0.22 0.20 0.26 0.31 0.16 0.25 1.00 0.62 0.07 0.23 0.28 0.13 0.22 0.62 1.00 0.02 0.10 0.07 0.11 0.20 0.07 0.02 1.00 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts