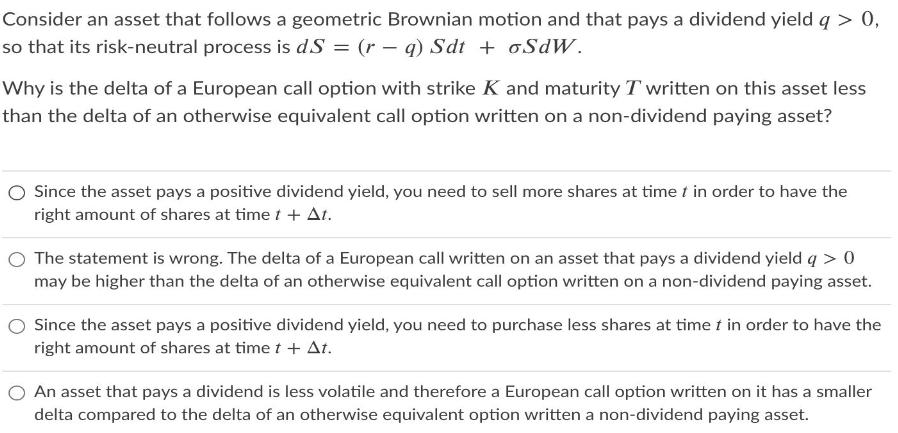

Question: Consider an asset that follows a geometric Brownian motion and that pays a dividend yield q > 0, so that its risk-neutral process is

Consider an asset that follows a geometric Brownian motion and that pays a dividend yield q > 0, so that its risk-neutral process is d.S = (ra) Sdt + oSdW. Why is the delta of a European call option with strike K and maturity T written on this asset less than the delta of an otherwise equivalent call option written on a non-dividend paying asset? Since the asset pays a positive dividend yield, you need to sell more shares at time t in order to have the right amount of shares at time t + At. The statement is wrong. The delta of a European call written on an asset that pays a dividend yield q> 0 may be higher than the delta of an otherwise equivalent call option written on a non-dividend paying asset. Since the asset pays a positive dividend yield, you need to purchase less shares at time I in order to have the right amount of shares at time t + At. An asset that pays a dividend is less volatile and therefore a European call option written on it has a smaller delta compared to the delta of an otherwise equivalent option written a non-dividend paying asset.

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

The statement The delta of a European call option with ... View full answer

Get step-by-step solutions from verified subject matter experts