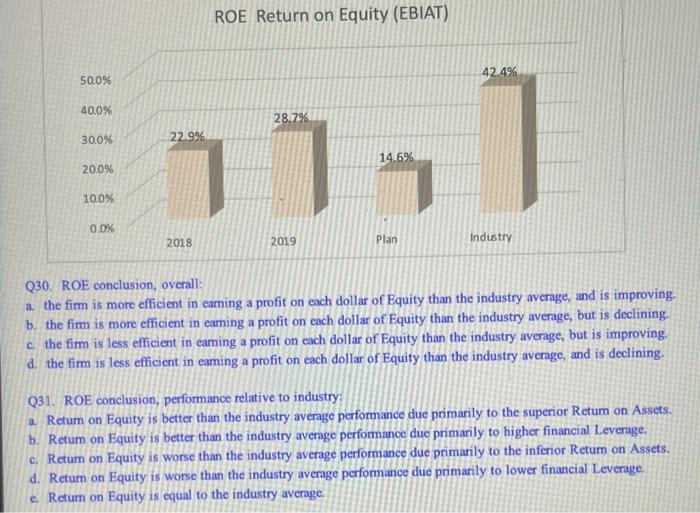

Question: thats the only data provided ROE Return on Equity (EBIAT) Q30. ROE conclusion, overall: a. the firm is more efficient in eaming a profit on

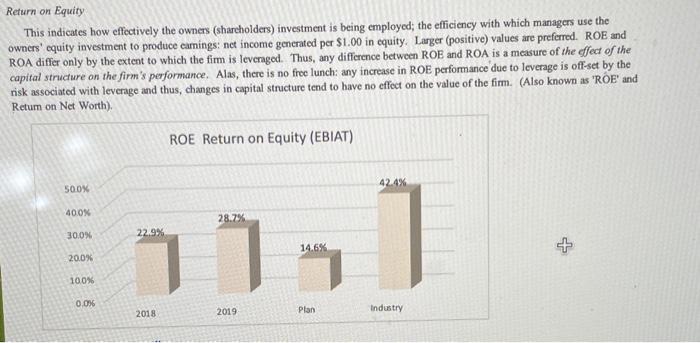

ROE Return on Equity (EBIAT) Q30. ROE conclusion, overall: a. the firm is more efficient in eaming a profit on cach dollar of Equity than the industry average, and is improving. b. the fim is more efficient in eaming a profit on each dollar of Equity than the industry average, but is declining. c. the firm is less efficient in earning a profit on each dollar of Equity than the industry average, but is improving. d. the firm is less efficient in eaming a profit on each dollar of Equity than the industry average, and is declining. Q31. ROE conclusion, performance relative to industry: a Retum on Equity is better than the industry average performance due primarily to the superior Retum on Assets. b. Retum on Equity is better than the industry average performance due primarily to higher financial Leverage. c. Retum on Equity is worse than the industry average performance due primarily to the inferior Retum on Assets. d. Retum on Equity is worse than the industry average perfomance due primarily to lower financial Leverage. e. Retum on Equity is equal to the industry average. Q32. ROE conclusion, performance trend: a. Retum on Equity improvement is due primarily to the improvement in Return on Assets. b. Retum on Equity improvement is due primanily to the increase in financial Leverage. c. Retum on Equity fell due primarily to the decline in Retum on Assets. d. Retum on Equity fell due primarily to the reduction in financial Leverage. e. Retum on Equity did not change compared to last year. Overall assessment of Capital Structure Q33. Capital Structure conclusion: a. The capital structure is fine; it is not burting the performance of the fim b. The financial Levernge is not at a safe level; the capital structure is hurting the performance of the fim. c. The financial Leverage is not at a safe level, but there are positive indicators of firm performance that suggest the capital structure is fine. Return on Equity This indicates how effectively the owners (sharcholders) investment is being employed; the efficiency with which managers use the owners' equity investment to produce eamings: net income generated per $1.00 in equity. Larger (positive) values are preferred. ROE and ROA differ only by the extent to which the fim is levernged. Thus, any difference between ROE and ROA is a measure of the effect of the capital structure on the firm's performance. Alas, there is no free lunch: any increase in ROE performance due to leverage is off-set by the risk associated with leverage and thus, changes in capital structure tend to have no effect on the value of the firm. (Also known as 'ROE' and Retum on Net Worth)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts