Question: thboard > My courses > A202_BWFF2033 A > Online Self-Learning > Mock Final Test Question 2 Not yet answered Marked out of 15.00 Flag question

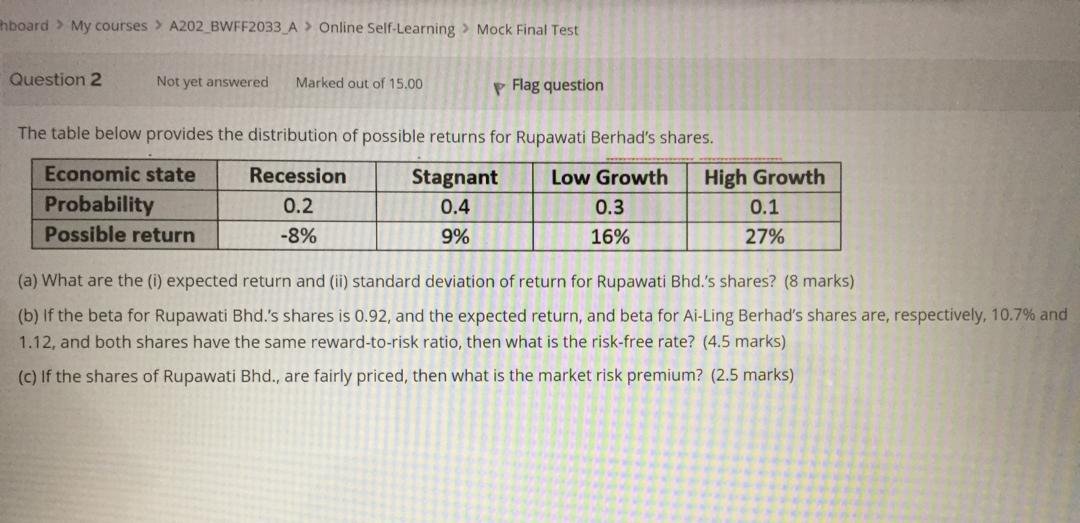

thboard > My courses > A202_BWFF2033 A > Online Self-Learning > Mock Final Test Question 2 Not yet answered Marked out of 15.00 Flag question The table below provides the distribution of possible returns for Rupawati Berhad's shares. Economic state Probability Possible return Recession 0.2 -8% Stagnant 0.4 9% Low Growth 0.3 16% High Growth 0.1 27% (a) What are the () expected return and (ii) standard deviation of return for Rupawati Bhd.'s shares? (8 marks) (b) If the beta for Rupawati Bhd.'s shares is 0.92, and the expected return, and beta for Ai-Ling Berhad's shares are, respectively, 10.7% and 1.12, and both shares have the same reward-to-risk ratio, then what is the risk-free rate? (4.5 marks) (c) If the shares of Rupawati Bhd., are fairly priced, then what is the market risk premium? (2.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts