Question: The 10-year average annual returns and standard deviations are shown below for various asset classes. Historical Risk vs. Return by Asset Class 10 High

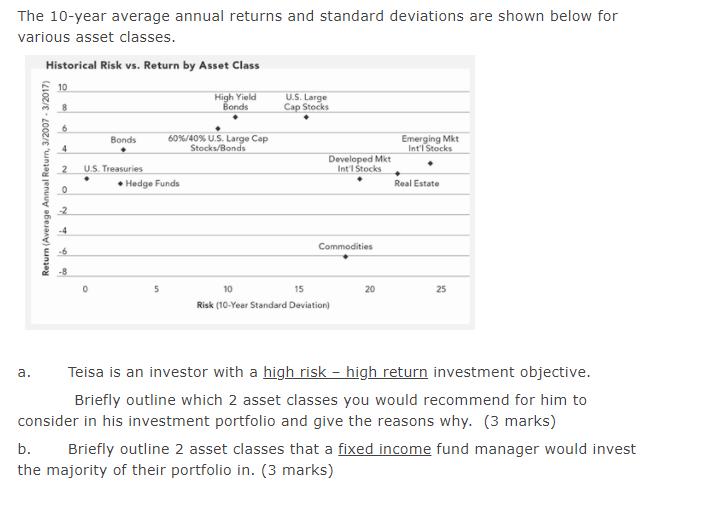

The 10-year average annual returns and standard deviations are shown below for various asset classes. Historical Risk vs. Return by Asset Class 10 High Yield Bonds U.S. Large Cap Stocks Bonds 60% /40 % U.S. Large Cap Stocks/Bonds Emerging Mkt Int'l Stocks 4 2 U.S. Treasuries 0 2 -4 -6 Return (Average Annual Return, 3/2007 -3/2017) Hedge Funds Developed Mkt Int'l Stocks Real Estate Commodities 0 10 15 20 25 Risk (10-Year Standard Deviation) a. Teisa is an investor with a high risk - high return investment objective. Briefly outline which 2 asset classes you would recommend for him to consider in his investment portfolio and give the reasons why. (3 marks) b. Briefly outline 2 asset classes that a fixed income fund manager would invest the majority of their portfolio in. (3 marks)

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

a An investor with high risk high return objective should select asset classes that have higher retu... View full answer

Get step-by-step solutions from verified subject matter experts