Question: The 4 question is inside the case study as I attached with picture. Answer straight to the point. CASE 3-7 Gillette: The 11-Cent Razor, India,

The 4 question is inside the case study as I attached with picture. Answer straight to the point.

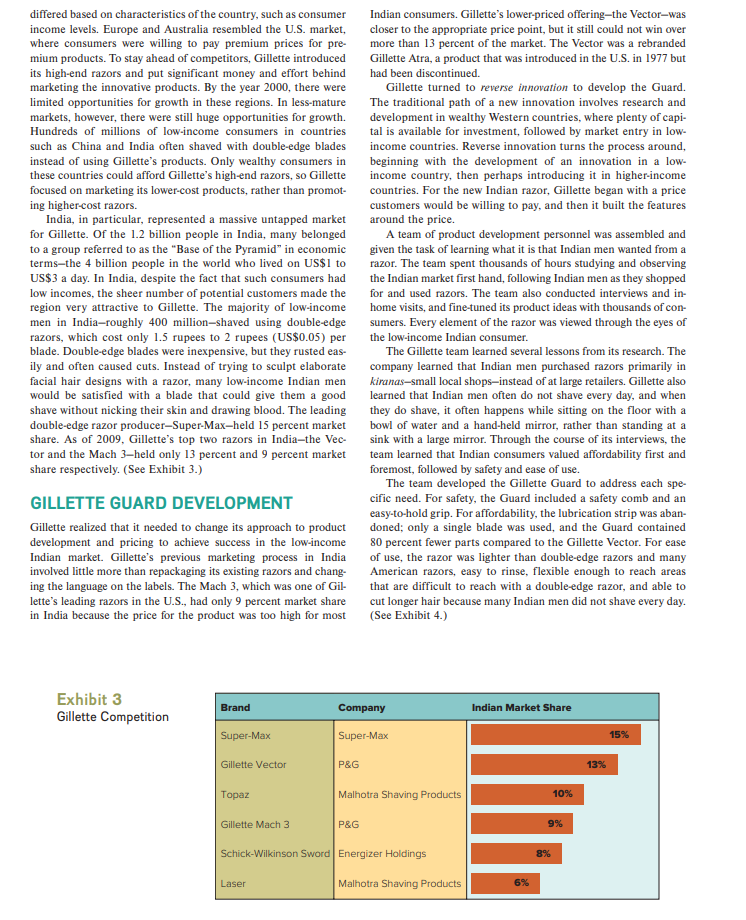

CASE 3-7 Gillette: The 11-Cent Razor, India, and Reverse Innovation In April of 2010, Gillette released its Guard razor, capturing Exhibit 1 50 percent of the Indian shaving market in just 6 months. The Straight-Edge Razor Guard was a lightweight, disposable-blade razor that was devel- oped after a year of research that involved observing Indian men as they purchased and used razors in their daily lives. The result was a 15-rupee (0.34 USD) razor with 5-rupee (0.11 USD) blades, uniquely designed for Indian men. To help the Guard reach the 50 percent milestone, Gillette had been aggressively promoting the product throughout the country of India, with billboards and TV commercials featuring Bollywood actors shaving with the razor. The price of the Guard was higher than that of the market- leading double-edge blades, but the new razor offered a close shave @productpackshotphotography/Getty Images without the frequent cuts that resulted from quick-rusting, double- edge models. In contrast, Gillette's leading product in the U.S.-the Gillette straight-edge razor becomes misaligned, and must be realigned Fusion ProGlide-was Gillette's most technologically innovative and polished by stropping the blade-dragging it along a strip of razor, with five blades on the skin contact surface. Gillette's fre- leather or canvas. While looking through a Montgomery Ward quent TV commercials touted the ability of the Fusion ProGlide mail-order catalog in 1895, Gillette noticed that Montgomery to give a comfortable, close shave, while enabling men to create Ward guaranteed that it would replace any defective razor, with elaborate facial hair designs. At $9.99 for the razor and $16.99 the disclaimer, if "properly used and stropped on a good smooth for a four-pack of blade cartridges, the Fusion ProGlide was not strop." Gillette recognized an opportunity to manufacture and only Gillette's most advanced razor, but it was also Gillette's most sell a razor with disposable blades that would not require main- expensive and most profitable razor. tenance. Patented in 1904, Gillette's "safety razor," as it came John Sebastian,' Gillette's manager of male grooming products, to be known, consisted of a razor (handle and blade compart- sat at his desk at company headquarters in Boston, Massachusetts, ment) and a disposable double-edge razor blade. (See Exhibit 2.) holding a Gillette Guard and a Gillette Fusion ProGlide in his Because customers would need to continuously buy new blades, hands, pondering next steps. Sebastian had been given the task of disposable razors would provide a steady, continuous source of revenue for Gillette. The company's original safety razor sold for analyzing market conditions and making a recommendation to the $5 in 1904 (about $135 in 2015 dollars), and a pack of blades vice president of male grooming for the Gillette Guard global strat- egy. There were over a billion men in low-income countries who that would last a year cost $1. potentially would be willing to try the Guard. The Guard could After expiration of the patent in 1921, Gillette feared that low- be a viable low-cost option for many Americans. Despite the fact cost imitators would erode his margins. Rather than simply reduce his prices, he took a two-pronged approach. First, shortly before that the premium-priced Fusion ProGlide was Gillette's best-selling the patent was set to expire, Gillette released an upgraded version razor, not every American was willing to pay such a high price. Many Americans were especially price sensitive due to the state of of the razor with a price of $5 and marked down the original razor the economy, which was slowly recovering from the 2008 financial crisis. Introducing the Guard to the U.S. market could allow Gil- lette to dominate the low end of the shaving industry and boost Exhibit 2 sales in a slow-growing market. On the other hand, Gillette's high margin products like the Fusion ProGlide might suffer if the Guard Safety Razor began to cannibalize sales. Sebastian was preparing for the meeting with his supervisor, during which he would offer his strategy recom- mendations to the vice president of male grooming for the Gillette Guard. The meeting was quickly approaching. COMPANY HISTORY The Gillette Company was founded in 1901 by King C. Gil- ette to manufacture his invention-the disposable-blade safety razor. At the time, the leading shaving products were straight- edge razors. (See Exhibit 1.) After repeated use, the blade of a The character and scenario are fictional. The company and market details are factual. Garobinson343/iStock/Getty Imagesto $1. This new upgrade kept Gillette ahead of competitors at the products and personal care items, such as antiperspirant and high end of the market. Increased sales of Gillette's original razor body wash. provided an even bigger boost to profits. The new, lower price convinced large numbers of customers to try the razor. Second, GILLETTE IN 2010 Gillette strategized that once these customers owned the razor, they would be forced to buy the blades at full price to continue By 2010, Gillette's male shaving product line was led by the using the razor. Recognizing the continuous stream of profits that Fusion ProGlide, a reengineered version of the Fusion razor with resulted from getting the razor into the hands of customers, Gil- five thin blades. The Fusion ProGlide was backed by a national lette began selling razors at low, promotional prices, and even giv- advertising campaign featuring celebrities including actor Adrien ing them away as a means to create demand for the high-margin Brody and hip-hop musician Andre 3000 with highly stylized blades. This method of selling an initial product at a low price to facial hair. Retailing for $10.99 ($11.99 for the battery-powered stimulate demand for a higher-margin-related product is used in vibrating version) with a four pack of blade cartridges that many industries but is still referred to as the "razor-and-blades" retailed for $16.99, the Fusion ProGlide was Gillette's best-selling business model. and most profitable product. Gillette's next most expensive prod- Throughout the 20th century, Gillette lived up to its slogan, uct was the Mach 3, which retailed for US$6.99 with a four pack 'The best a man can get," by continuously developing the next of blade cartridges selling for US$ 10.49. Gillette also sold several "best" razor to the market every few years. Gillette's innova- types of disposable razors, with prices as low as US$0.65 each tions included a "Twist to Open" double-edge razor (Aristocrat, when purchased in a multipack. The company benefited from a released in 1934), a two-blade razor (Trac II, 1971), a razor with "trade-up" strategy-consumers often moved up from Gillette's a pivoting head (Atra, 1977), a razor with spring-loaded blades less expensive products to its more-expensive ones, but rarely (Sensor, 1990), a three-blade razor (Mach 3, 1998), and a five- moved down the price scale. In this sense, cannibalization of the blade razor (Fusion. 2006). Several variations of these prod- sales of existing products in favor of newer, more profitable ones ucts also were sold, including a women's version of the Mach 3 was a fortuitous circumstance. (Venus), battery-powered razors that vibrated for an ever-closer Gillette's brand recognition, market share, and advantages shave (e.g., Fusion Power), and razors with various combinations in technology and manufacturing had kept it at the top of the of features such as color schemes and lubricating strips. Gillette razor market since the company's founding. Gillette's leading also developed several disposable razors in which the entire razor, competitor-Schick-held a 15 percent global market share com- not just the blade, was to be thrown away after the blade became pared to Gillette's 70 percent. Throughout the 2000s, however, dull. Gillette expanded into the electric shaver market in 1967 by Schick put pressure on Gillette as the two companies engaged in purchasing Braun, a German consumer products manufacturer. what the media referred to as the "Razor Wars." Schick was the Electric shavers, in general, are faster and safer than shaving with first company to release a razor with four blades: the Quattro. Gil- a manual razor but are not able to provide the close shave of a lette's Fusion ProGlide was then the first razor with five blades. traditional razor. Schick quickly followed with its own five-blade razor-the Hydro From the 1950s through the end of the 20th century, Gillette 5. Volume growth in the U.S. shaving industry had been stagnant expanded into product lines outside of shaving by purchasing for several years, with sales growth derived primarily from price market-leading brands such as Duracell, Liquid Paper, and Cricket increases attached to new, innovative products. Lighters. Razors remained Gillette's core business, however, con- Gillette, however, faced stiff competition in the disposable razor sistently accounting for more than half of the company's profits. category, which was at the low end of the razor market. Gillette's The 1990s were an especially prosperous time for Gillette. The lowest-cost razors offered advanced features such as dual blades, company developed innovative new products in all of its major pivoting heads, and lubricating strips. Competitors such as Bic, product categories, while experiencing rapid growth in new mar- Wilkinson Sword, and Schick not only sold products that rivaled kets such as China and Eastern Europe. Gillette's stock price grew Gillette's disposable razors in terms of features and price, but also more than tenfold from the late 1980s to the late 1990s. But by produced bare-bones versions of the products. These very-low-end the early 2000s, the company's rate of innovation and international razors could be purchased for as low as $0.20 when purchased in expansion had slowed, and, with it, Gillette's sales. Gillette's earn- a multipack. ings came in below estimates for 15 consecutive quarters, due in Gillette also faced competition from store brands ("private part to what board member Warren Buffett commented were unre- labels"), or razors that would be a brand unique only to that store alistically high estimates. (such as "Great Value" in Walmart). Otherwise, nationally branded Jim Kilts was hired as Gillette Chief Executive Officer (CEO) products were primarily sold to retailers that, in turn, sold the prod- in 2001. Kilts' mission was to reinvigorate the company, turn- ucts to consumers. Throughout the 1990s, the retail industry under- ing it around by reducing costs and reinvesting the savings into went consolidation, with Walmart becoming the largest player and aggressive research and development. This new strategy brought Gillette's largest customer. Walmart's purchasing power, as well as its Gillette back to profitability, and it posted six consecutive quar- low-priced store brands, enabled it to place downward price pressure ters of record profits. Despite the company's rebound, Kilts on its suppliers. Despite the lower prices, however, the store brands believed that relying so heavily on razors would endanger the did not take significant market share from name-brand products. company in the long run. Gillette merged with Proctor & Gam ble (P&G) in 2005 to take advantage of the marketing and distri- INTERNATIONAL STRATEGY bution strength of P&G's global organization. Although billed as a merger, the deal was essentially a $57 billion acquisition of Gil- By 2010, Gillette held 70 percent of the global market share for lette. After 2005, several business units were separated from Gil- razors. The market share varied by region, and Gillette's indi- lette, returning the company's focus to its core business-shaving vidual country strategies of product development and pricingdiffered based on characteristics of the country, such as consumer Indian consumers. Gillette's lower-priced offering-the Vector-was income levels. Europe and Australia resembled the U.S. market, closer to the appropriate price point, but it still could not win over where consumers were willing to pay premium prices for pre- more than 13 percent of the market. The Vector was a rebranded mium products. To stay ahead of competitors, Gillette introduced Gillette Atra, a product that was introduced in the U.S. in 1977 but its high-end razors and put significant money and effort behind had been discontinued. marketing the innovative products. By the year 2000, there were Gillette turned to reverse innovation to develop the Guard. limited opportunities for growth in these regions. In less-mature The traditional path of a new innovation involves research and markets, however, there were still huge opportunities for growth. development in wealthy Western countries, where plenty of capi- Hundreds of millions of low-income consumers in countries tal is available for investment, followed by market entry in low- such as China and India often shaved with double-edge blades income countries. Reverse innovation turns the process around, instead of using Gillette's products. Only wealthy consumers in beginning with the development of an innovation in a low- these countries could afford Gillette's high-end razors, so Gillette income country, then perhaps introducing it in higher-income focused on marketing its lower-cost products, rather than promot- countries. For the new Indian razor, Gillette began with a price ing higher-cost razors. customers would be willing to pay, and then it built the features India, in particular, represented a massive untapped market around the price. for Gillette. Of the 1.2 billion people in India, many belonged A team of product development personnel was assembled and to a group referred to as the "Base of the Pyramid" in economic given the task of learning what it is that Indian men wanted from a terms-the 4 billion people in the world who lived on US$1 to razor. The team spent thousands of hours studying and observing US$3 a day. In India, despite the fact that such consumers had the Indian market first hand, following Indian men as they shopped low incomes, the sheer number of potential customers made the for and used razors. The team also conducted interviews and in- region very attractive to Gillette. The majority of low-income home visits, and fine-tuned its product ideas with thousands of con- men in India-roughly 400 million-shaved using double-edge sumers. Every element of the razor was viewed through the eyes of razors, which cost only 1.5 rupees to 2 rupees (US$0.05) per the low-income Indian consumer. blade. Double-edge blades were inexpensive, but they rusted eas- The Gillette team learned several lessons from its research. The ily and often caused cuts. Instead of trying to sculpt elaborate company learned that Indian men purchased razors primarily in facial hair designs with a razor, many low-income Indian men kiranas-small local shops-instead of at large retailers. Gillette also would be satisfied with a blade that could give them a good learned that Indian men often do not shave every day, and when shave without nicking their skin and drawing blood. The leading they do shave, it often happens while sitting on the floor with a double-edge razor producer-Super-Max-held 15 percent market bowl of water and a hand-held mirror, rather than standing at a share. As of 2009, Gillette's top two razors in India-the Vec- sink with a large mirror. Through the course of its interviews, the tor and the Mach 3-held only 13 percent and 9 percent market team learned that Indian consumers valued affordability first and share respectively. (See Exhibit 3.) foremost, followed by safety and ease of use. The team developed the Gillette Guard to address each spe- GILLETTE GUARD DEVELOPMENT cific need. For safety, the Guard included a safety comb and an easy-to-hold grip. For affordability, the lubrication strip was aban- Gillette realized that it needed to change its approach to product doned; only a single blade was used, and the Guard contained development and pricing to achieve success in the low-income 80 percent fewer parts compared to the Gillette Vector. For ease Indian market. Gillette's previous marketing process in India of use, the razor was lighter than double-edge razors and many involved little more than repackaging its existing razors and chang- American razors, easy to rinse, flexible enough to reach areas ing the language on the labels. The Mach 3, which was one of Gil- that are difficult to reach with a double-edge razor, and able to lette's leading razors in the U.S., had only 9 percent market share cut longer hair because many Indian men did not shave every day. in India because the price for the product was too high for most (See Exhibit 4.) Exhibit 3 Brand Company Indian Market Share Gillette Competition Super-Max Super-Max 15% Gillette Vector P&G 13% Topaz Malhotra Shaving Products 10% Gillette Mach 3 P&G 9% Schick-Wilkinson Sword | Energizer Holdings 3% Laser Malhotra Shaving Products 6%\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts