Question: the answer for the problem should be -6,438,568 but i have no idea how to get that for the answer. please help if you can,

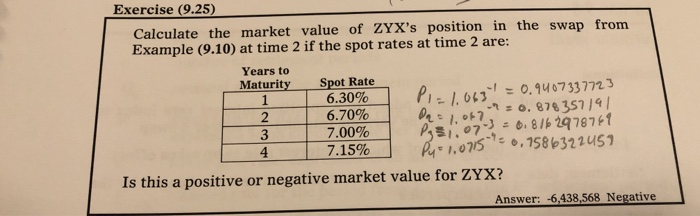

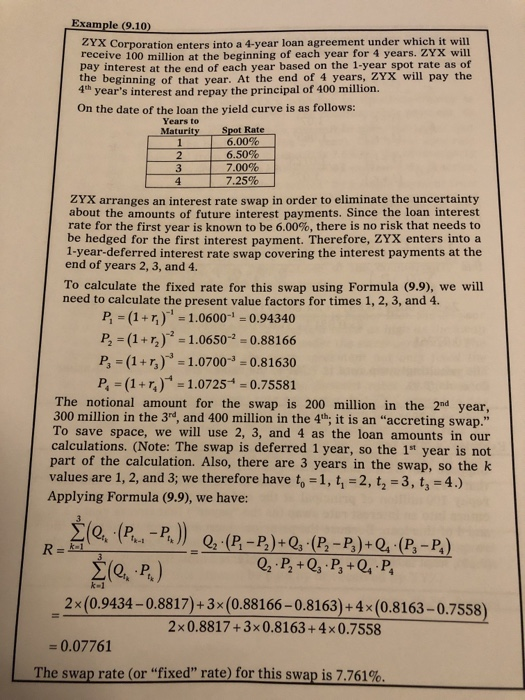

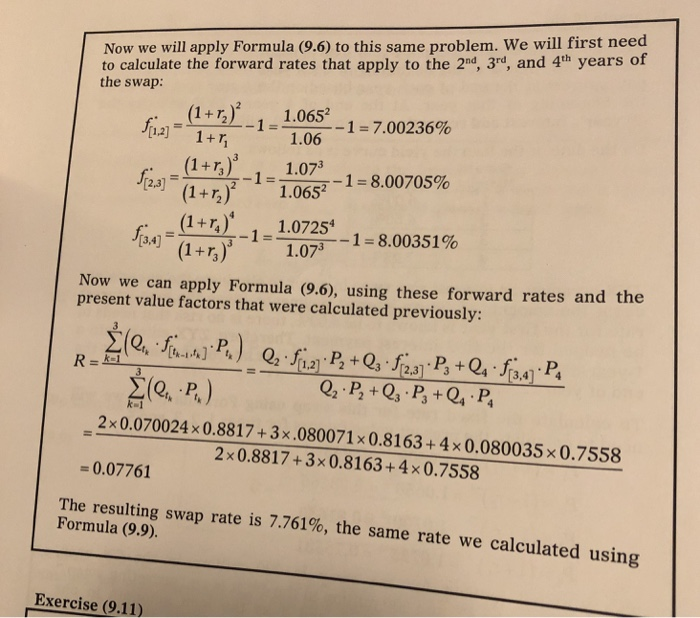

Exercise (9.25) Calculate the market value of ZYX's position in the swap from Example (9.10) at time 2 if the spot rates at time 2 are: Years to Maturity Spot Rate 6.30% Pic063 = 0.9407337723 6.70% D .087.= 0,878357191 Ps: 07-3 = 0.816 2978761 7.15% Pur1,0715 0,7586322451 Is this a positive or negative market value for ZYX? Answer: -6,438,568 Negative Example (9.10) ZYX Corporation enters into a 4-year loan agreement under which it will receive 100 million at the beginning of each year for 4 years. ZYX will pay interest at the end of each year based on the 1-year spot rate as of the beginning of that year. At the end of 4 years, ZYX will pay the 4 year's interest and repuy the principal of 400 million. On the date of the loan the yield curve is as follows: Years to Maturity Spot Rate 1 6.0096 2 6.50% 3 7.00% 7.25% ZYX arranges an interest rate swap in order to eliminate the uncertainty about the amounts of future interest payments. Since the loan interest rate for the first year is known to be 6.00%, there is no risk that needs to be hedged for the first interest payment. Therefore, ZYX enters into a 1-year-deferred interest rate swap covering the interest payments at the end of years 2, 3, and 4. To calculate the fixed rate for this swap using Formula (9.9), we will need to calculate the present value factors for times 1, 2, 3, and 4. P. = (1 + r.) = 1.0600-= 0.94340 P, = (1+r)' = 1.0650-2 = 0.88166 P, = (1 + r) = 1.0700-) = 0.81630 P = (1 + r) * = 1.07254 = 0.75581 The notional amount for the swap is 200 million in the 2nd year, 300 million in the 3rd, and 400 million in the 4th, it is an "accreting swap." To save space, we will use 2, 3, and 4 as the loan amounts in our calculations. (Note: The swap is deferred 1 year, so the 1st year is not part of the calculation. Also, there are 3 years in the swap, so the k values are 1, 2, and 3; we therefore have to =1, t, = 2, t, = 3, t, -4.) Applying Formula (9.9), we have: Q (P-P.) Q (P, -P)+Q3 (PZ - P+(P;-P) Q P+Q P+Q, P, 2x(0.9434 -0.8817)+3x(0.88166 -0.8163) + 4x(0.8163 -0.7558) 2x0.8817+3x0.8163+4x0.7558 = 0.07761 The swap rate (or "fixed" rate) for this swap is 7.761%. Now we will apply Formula (9.6) to this same problem. We will first need to calculate the forward rates that apply to the 2nd, 3rd, and 4th years of the swap: fi- (1+r)^_1_1.0652 [1,2] 1+r + 1.06 - 1 = 7.00236% f - (1+13)_1_1.073 1.0652 -1 = 8.00705% fgn = (1+r) - 1 - 1.07254 (1+r) 1.073-1= 8.00351% Now we can apply Formula (9.6), using these forward rates and the present value factors that were calculated previously: (OF P) Q2 f12. P+Qz+f123) Pz+Q4. f34PA (Q, P.) Q P +Q P + Q . Pa 2x0.070024 x0.8817+ 3x.080071~0.8163+4x0.080035x0.7558 2x0.8817+3x0.8163+4x0.7558 = 0.07761 The resulting swap rate is 7.761%, the same rate we calculated using Formula (9.9). Exercise (9.11) Exercise (9.25) Calculate the market value of ZYX's position in the swap from Example (9.10) at time 2 if the spot rates at time 2 are: Years to Maturity Spot Rate 6.30% Pic063 = 0.9407337723 6.70% D .087.= 0,878357191 Ps: 07-3 = 0.816 2978761 7.15% Pur1,0715 0,7586322451 Is this a positive or negative market value for ZYX? Answer: -6,438,568 Negative Example (9.10) ZYX Corporation enters into a 4-year loan agreement under which it will receive 100 million at the beginning of each year for 4 years. ZYX will pay interest at the end of each year based on the 1-year spot rate as of the beginning of that year. At the end of 4 years, ZYX will pay the 4 year's interest and repuy the principal of 400 million. On the date of the loan the yield curve is as follows: Years to Maturity Spot Rate 1 6.0096 2 6.50% 3 7.00% 7.25% ZYX arranges an interest rate swap in order to eliminate the uncertainty about the amounts of future interest payments. Since the loan interest rate for the first year is known to be 6.00%, there is no risk that needs to be hedged for the first interest payment. Therefore, ZYX enters into a 1-year-deferred interest rate swap covering the interest payments at the end of years 2, 3, and 4. To calculate the fixed rate for this swap using Formula (9.9), we will need to calculate the present value factors for times 1, 2, 3, and 4. P. = (1 + r.) = 1.0600-= 0.94340 P, = (1+r)' = 1.0650-2 = 0.88166 P, = (1 + r) = 1.0700-) = 0.81630 P = (1 + r) * = 1.07254 = 0.75581 The notional amount for the swap is 200 million in the 2nd year, 300 million in the 3rd, and 400 million in the 4th, it is an "accreting swap." To save space, we will use 2, 3, and 4 as the loan amounts in our calculations. (Note: The swap is deferred 1 year, so the 1st year is not part of the calculation. Also, there are 3 years in the swap, so the k values are 1, 2, and 3; we therefore have to =1, t, = 2, t, = 3, t, -4.) Applying Formula (9.9), we have: Q (P-P.) Q (P, -P)+Q3 (PZ - P+(P;-P) Q P+Q P+Q, P, 2x(0.9434 -0.8817)+3x(0.88166 -0.8163) + 4x(0.8163 -0.7558) 2x0.8817+3x0.8163+4x0.7558 = 0.07761 The swap rate (or "fixed" rate) for this swap is 7.761%. Now we will apply Formula (9.6) to this same problem. We will first need to calculate the forward rates that apply to the 2nd, 3rd, and 4th years of the swap: fi- (1+r)^_1_1.0652 [1,2] 1+r + 1.06 - 1 = 7.00236% f - (1+13)_1_1.073 1.0652 -1 = 8.00705% fgn = (1+r) - 1 - 1.07254 (1+r) 1.073-1= 8.00351% Now we can apply Formula (9.6), using these forward rates and the present value factors that were calculated previously: (OF P) Q2 f12. P+Qz+f123) Pz+Q4. f34PA (Q, P.) Q P +Q P + Q . Pa 2x0.070024 x0.8817+ 3x.080071~0.8163+4x0.080035x0.7558 2x0.8817+3x0.8163+4x0.7558 = 0.07761 The resulting swap rate is 7.761%, the same rate we calculated using Formula (9.9). Exercise (9.11)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts