Question: The answer is choice B but I need to know how to solve it. Suppose that you manage a pension fund that has liabilities of

The answer is choice B but I need to know how to solve it.

The answer is choice B but I need to know how to solve it.

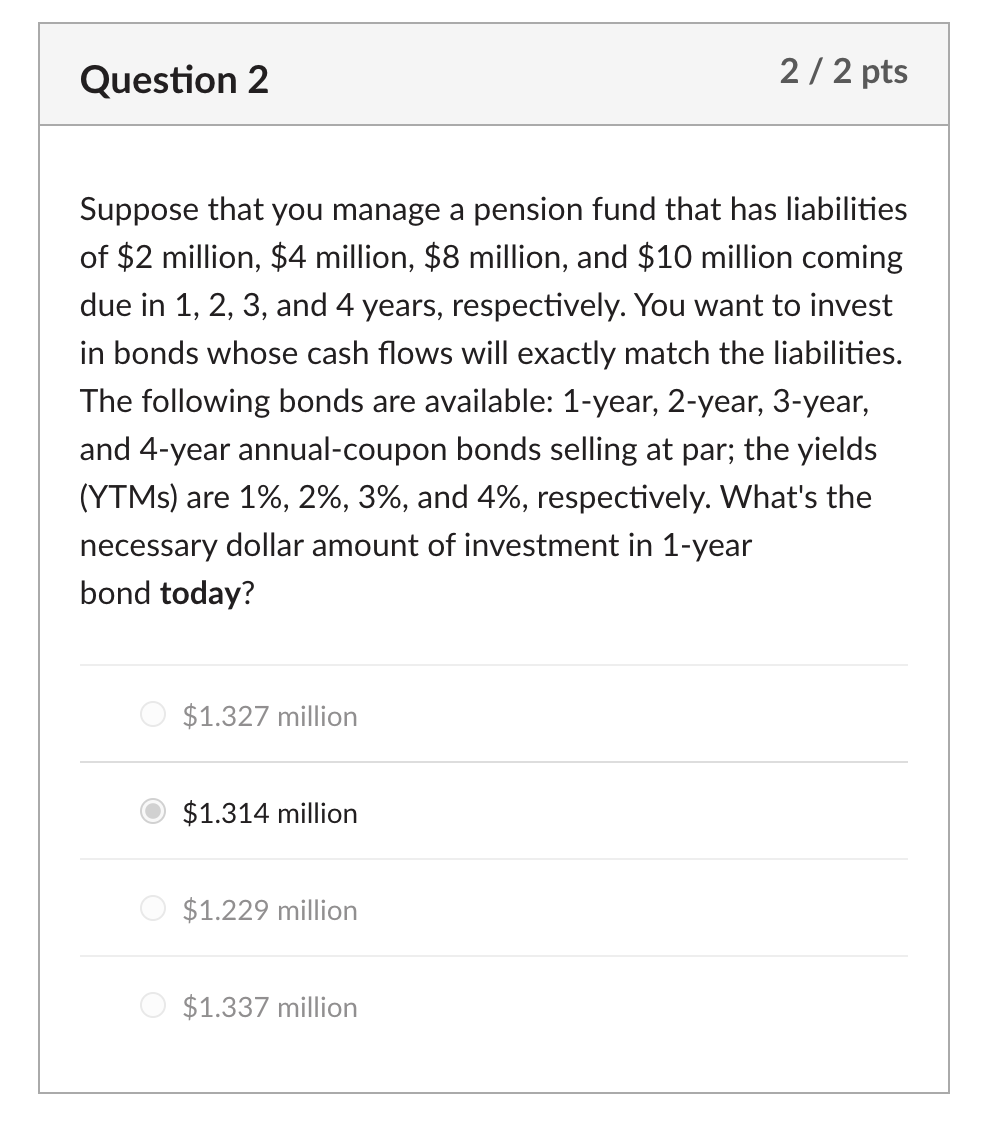

Suppose that you manage a pension fund that has liabilities of $2 million, $4 million, $8 million, and $10 million coming due in 1, 2, 3, and 4 years, respectively. You want to invest in bonds whose cash flows will exactly match the liabilities. The following bonds are available: 1-year, 2-year, 3-year, and 4-year annual-coupon bonds selling at par; the yields (YTMs) are 1%,2%,3%, and 4%, respectively. What's the necessary dollar amount of investment in 1-year bond today? \$1.327 million \$1.314 million \$1.229 million \$1.337 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts