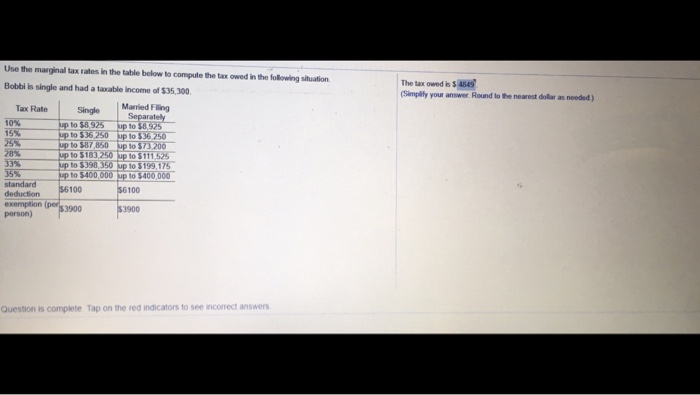

Question: The answer is right there, how do you solve for the answer? Use the marginal tax rates in the table below to compute the tax

Use the marginal tax rates in the table below to compute the tax owed in the folowing situation Bobbi Is single and had a taxable income of $35,300 The tax owed is$ 4849 Simplify your answer Round to the nearest dollar as needed) Tax Rate Married Fling o $36,2 to $8 o $362 28% up to $183 250 p 15111 5 up to $398,350 up to $199,175 up to $400 000APIT400 000- deduction 36100 exemption (pers 3900 person) 6100 Question is complete Tap on the red indicators to see incorrect answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts