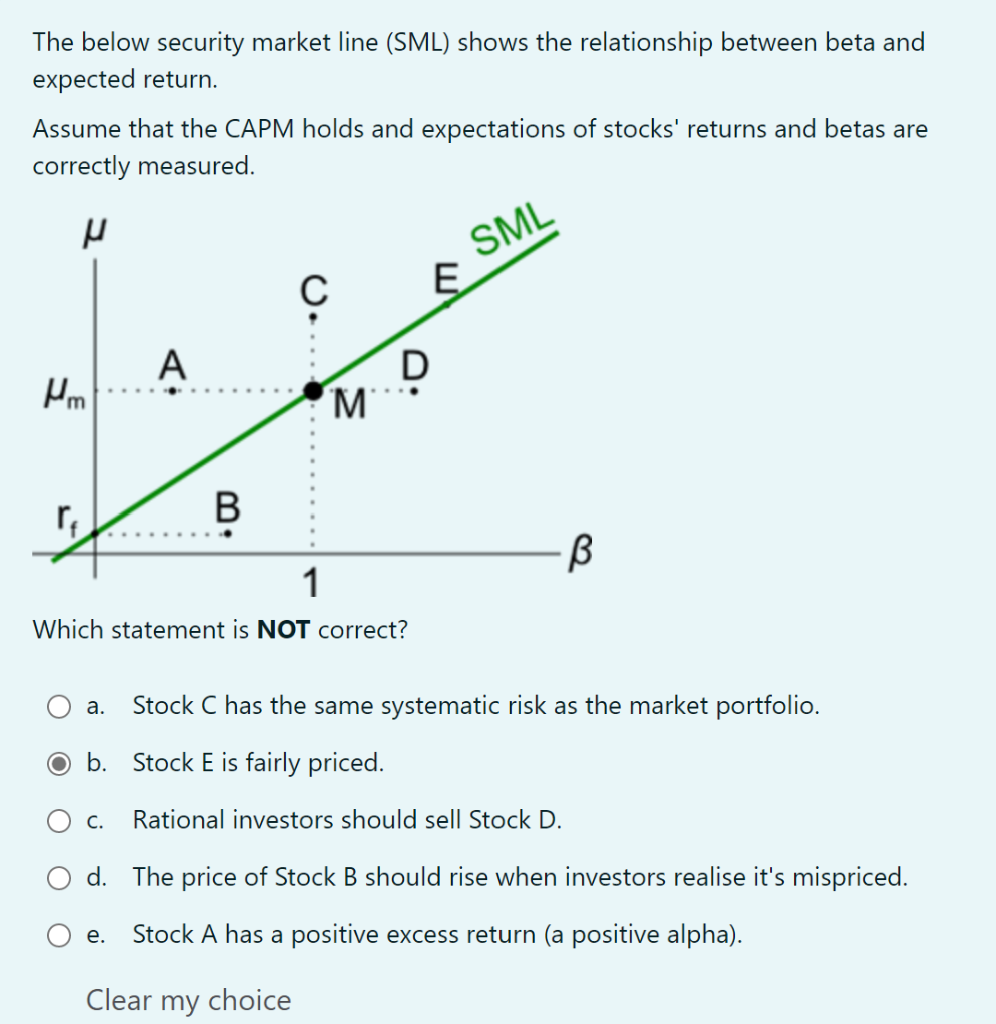

Question: The below security market line (SML) shows the relationship between beta and expected return. Assume that the CAPM holds and expectations of stocks' returns and

The below security market line (SML) shows the relationship between beta and expected return. Assume that the CAPM holds and expectations of stocks' returns and betas are correctly measured. SML A D Mm M B 1 Which statement is NOT correct? a. Stock C has the same systematic risk as the market portfolio. O b. Stock E is fairly priced. C. Rational investors should sell Stock D. d. The price of Stock B should rise when investors realise it's mispriced. e. Stock A has a positive excess return (a positive alpha). Clear my choice

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock