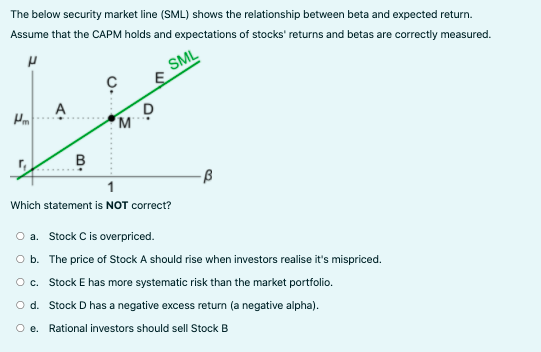

Question: The below security market line (SML) shows the relationship between beta and expected return. Assume that the CAPM holds and expectations of stocks' returns and

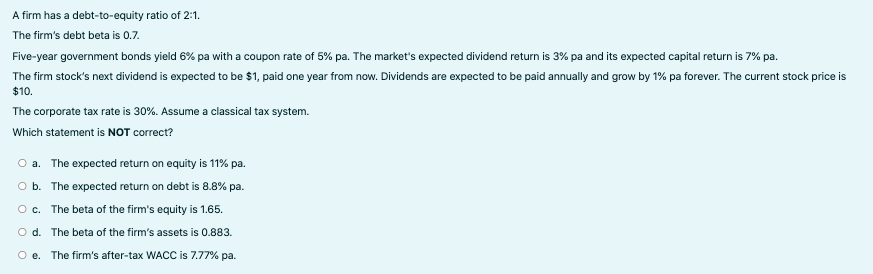

The below security market line (SML) shows the relationship between beta and expected return. Assume that the CAPM holds and expectations of stocks' returns and betas are correctly measured. SML E A H. D M B B Which statement is NOT correct? O a Stock C is overpriced. O b. The price of Stock A should rise when investors realise it's mispriced. O c. Stock E has more systematic risk than the market portfolio. O d. Stock D has a negative excess return (a negative alpha). Rational investors should sell Stock B A firm has a debt-to-equity ratio of 2:1. The firm's debt beta is 0.7. Five-year government bonds yield 6% pa with a coupon rate of 5% pa. The market's expected dividend return is 3% pa and its expected capital return is 7% pa. The firm stock's next dividend is expected to be $1, paid one year from now. Dividends are expected to be paid annually and grow by 1% pa forever. The current stock price is $10. The corporate tax rate is 30%. Assume a classical tax system. Which statement is NOT correct? O a. The expected return on equity is 11% pa. O b. The expected return on debt is 8.8% pa. Oc. The beta of the firm's equity is 1.65. Od. The beta of the firm's assets is 0.883. Oe. The firm's after-tax WACC is 7.77% pa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts